4.5: Common Ownership Self-Assessed Tax

ECON 410 · Public Economics · Spring 2020

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/publics20

publicS20.classes.ryansafner.com

A Brief History of Property in Land

Radical Markets

Eric Posner

Glen Weyl

The Efficiency of Private Property

- Allocative efficiency: property used for most valuable uses

- Those who value property more have higher WTP than owners, efficient transfer

- Coase Theorem (with no transaction costs)

The Efficiency of Private Property

- Investment efficiency: owners are compensated for maintaining and investing resources in improving the quality

- Earns a higher value (capital gain) when selling at higher price

- Internalizing positive externality

- Compare to common property

From Feudalism to Capitalism

Feudalism: heavy restraints on trade

- Social class, and attendent duties, or privileges, tied to land-ownership

Peasants are bonded tenants that rent land from landlords

- Farm for subsistence on lord's manor, pay lord feudal rents (often surplus of farmed output, later money)

Land used for inefficient, subsistence agriculture

From Feudalism to Capitalism

Capitalism as "right to trade"

Industrial Revolution, Enclosure movement

Breakdown of feudal restrictions & obligations

A market for land develops

- land sold to rising industrialists

- put to more efficient uses than subsistence farming

The Absentee Landlord

Peasant-tenants have little incentive to improve land

- landlords will confiscate whatever surplus they create

Most wealthy landlords inherited land and lazily collected their rents

- little incentive to improve it, absenteeism

The Absentee Landlord

- Landlords benefitted from industrial revolution

- Higher demand for land ⟹ higher rents

- Some refused to sell to rising industrialists

- land remains inefficiently for subsistence agriculture

- Landlords seen as parasites

Land as Monopoly

Land ownership may be considered a monopoly

- Each lot of land has unique qualities, location, no perfect substitutes

- Posner & Weyl: "the monopoly problem"

Landowner can hope to earn higher returns by holding out for a better offer to sell

- Meanwhile, the land is un(der)used, reducing allocative efficiency

Land as Monopoly

Posner & Weyl: "the monopoly problem" is largely true of ownership in general (of any asset)

Estimate 25% loss of national output from monopoly problem

Some History of Economic Thought on Land and Rent

Adam Smith on Land and Rent

Adam Smith

1723-1790

"As soon as the land of any country has all become private property, the landlords, like all other men, love to reap where they never sowed, and demand a rent even for its natural produce. The wood of the forest, the grass of the field, and all the natural fruits of the earth, which, when land was in common, cost the labourer only the trouble of gathering them, come, even to him, to have an additional price fixed upon them. He must then pay for the licence to gather them; and must give up to the landlord a portion of what his labour either collects or produces. This portion, or, what comes to the same thing, the price of this portion, constitutes the rent of land," (Book I, Chapter XI)"

Smith, Adam, 1776, An Enquiry into the Nature and Causes of the Wealth of Nations

Adam Smith on Land and Rent

Adam Smith

1723-1790

"The rent of land, therefore, considered as the price paid for the use of the land, is naturally a monopoly price. It is not at all proportioned to what the landlord may have laid out upon the improvement of the land, or to what he can afford to take; but to what the farmer can afford to give," (Book I, Chapter XI)"

Smith, Adam, 1776, An Enquiry into the Nature and Causes of the Wealth of Nations

David Ricardo on Land and Rent

David Ricardo

1772-1823

"Thus by bringing successively land of a worse quality, or less favourably situated into cultivation, rent would rise on the land previously cultivated, and precisely in the same degree would profits fall; and if the smallness of profits do not check accumulation, there are hardly any limits to the rise of rent, and the fall of profit,"

Ricardo, David, 1815, Essay on the Influence of a Low Price of Corn on the Profits of Stock

David Ricardo on Land and Rent

David Ricardo

1772-1823

- In Ricardo's view, land was a fixed factor

- Start cultivation on most (agriculturally) productive land first

- Extend cultivation into worse marginal land and worse marginal land...

- As more land is used, more and more labor and capital would be needed to increase output (diminishing returns to land)

David Ricardo on Land and Rent

David Ricardo

1772-1823

Ultimately, marginal product of land would fall to 0 ⟹ economy in a permanent stationary state

- Profits to capital fall to 0

- Wages to laborers fall to subsistence level

- Rents to land skyrocket due to land being the fixed factor

This is the origin of Ricardian rent or economic rent (as in "rent-seeking")

Marginalist Revolution in Economics (1870s)

Marginal Revolutionaries on Land

William Stanley Jevons

1835-1882

"Property is only another name for monopoly."

Marginal Revolutionaries on Land

Leon Walras

1834-1910

"Declaring individual land ownership [means] thwarting the beneficial effects of free competition by preventing the land from being used as is most advantageous for society."

"[By ending] individual landownership and monopolies [we can] suppress [the] true causes [of] feudality."

Marginal Revolutionaries on Land

Leon Walras

1834-1910

Walras suggested "synthetic socialism"

Land owned by the government and rents it generates returned to public as a "social dividend" or put towards producing public goods

Hostile to central planning

- feared government planners would become the new feudal landlords

- need to maintain competition

Radical Markets

"In the late nineteenth century, socialism was a rather amorphous term and was not always associated with central planning. Socialists agreed only on one point: that traditional private property and the inequality of its ownership posed significant challenges to prosperity, well-being, and political order," (p. 42).

Posner, Eric and E. Glen Weyl, 2017, Radical Markets

Georgism

Henry George

1839-1897

"The nineteenth century saw an enormous increase in the ability to produce wealth. Steam and electricity, mechanization, specialization, and new business methods greatly increased the power of labor...Surely, these new powers would elevate society from its foundations, lifting the poorest above worry for the material needs of life...Yet we must now face facts we cannot mistake. All over the world we hear complaints of...labor condemned to involuntary idleness; capital going to waste...Where do we find the deepest poverty, the hardest struggle for existence, the greatest enforced idleness? Why, wherever material progress is most advanced...This relation of poverty to progress is the great question of our time."

George, Henry, 1879, Progress and Poverty (quoted in Posner and Weyl, 2017, pp.36-37)

Georgist Solutions

Henry George

1839-1897

A "simpler, easier and quieter way" to solve the problem is to "appropriate land rent for public use, by taxation"

Land ("Gifts of nature") vs. "artifical capital" (human-made improvements)

Solution: allow private ownership in artificial capital, but abolish private ownership in land

- but not centrally-planned, competitively managed

Georgist Solutions

Henry George

1839-1897

"Competitive common ownership"

Government owns all land, and leases it out to those it thinks make the most productive use of it

- Terminates lease when a better buyer (higher WTP) comes along

Individuals and businesses rent, but cannot own, land

Georgist Solutions: A Land Value Tax

Henry George

1839-1897

Modern (State and local) property taxes:

- low rates (1 or 2%)

- assess the full value of your house (land lot + structures)

- determined by a government assessor

Versus George's land value tax:

- tax the full value (100%) of rent needed to occupy land

- artificial capital (i.e. structures) not taxed

- assessors need to evaluate value of the unimproved land (i.e. if structures were bulldozed)

Consequences of a Land Value Tax

Henry George

1839-1897

Occupants enjoy full value of improvements and structures built on land (privately owned)

Act as a tenant of the land (government is landlord), pay full rent value in taxes

People who can productively use land have high WTP the tax, those who would leave it idle would sell at low prices to avoid tax (no more absentee landlords)

Georgists often believed this "single tax" could replace all other taxes

Monopoly and The Landlord's Game

"The Landlord's Game" created in 1902 to popularize Georgism

The famous Parker Brothers "Monopoly" board game based on this around 1930s (and interesting disputes about who invented it)

Monopoly and The Landlord's Game

"The Landlord's Game" created in 1902 to popularize Georgism

The famous Parker Brothers "Monopoly" board game based on this around 1930s (and interesting disputes about who invented it)

Economic Incidence of a Tax on Land Value

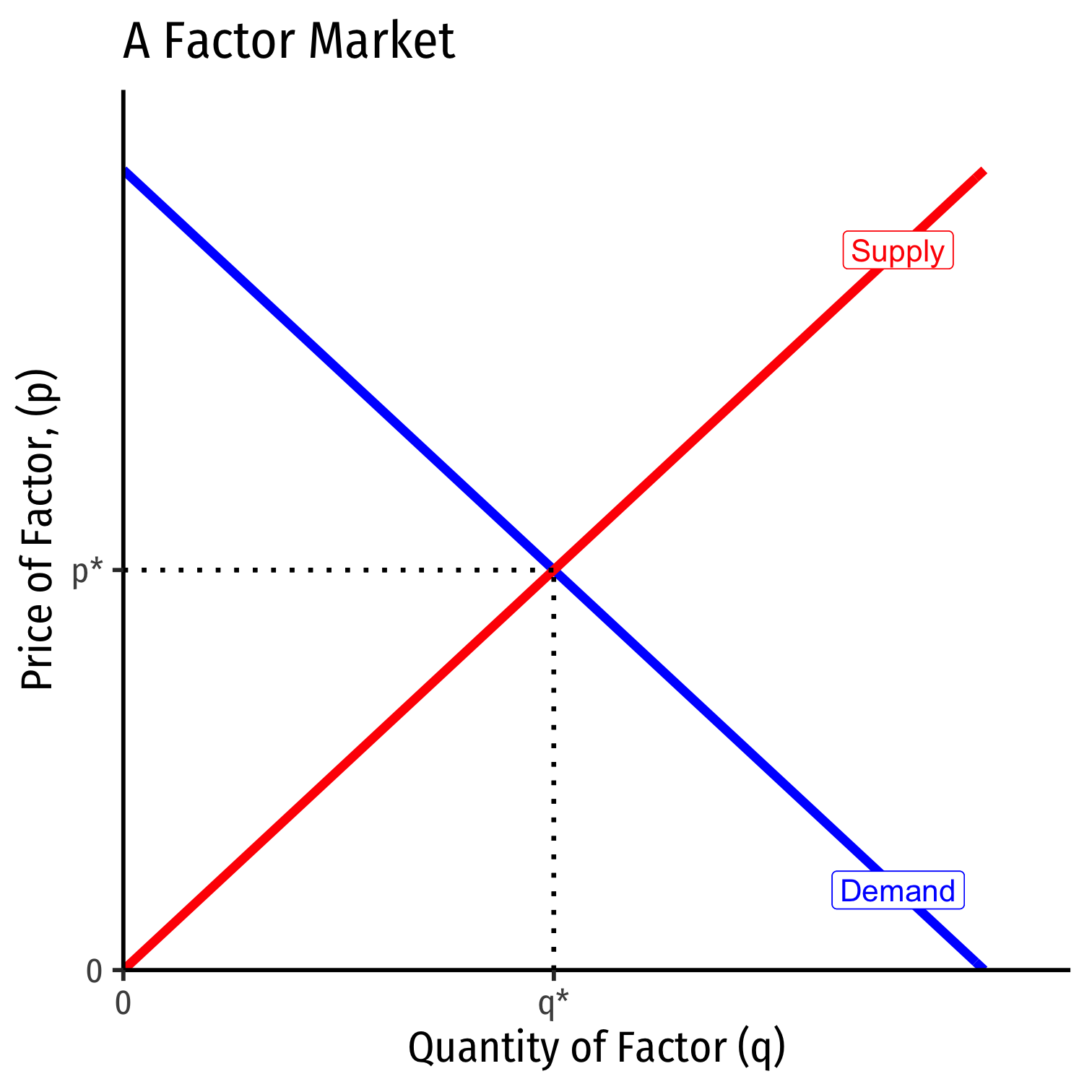

Factor Supply & Economic Rent I

Consider a market for a factor of production (inputs: land, labor, capital, etc.)

Recall market demand is the maximum willingness of firms to pay factor owners for use of the factor

Recall market supply is the minimum willingness of factor owners to accept, the minimum price necessary to bring a resource to market

But all (equivalent) factor units are paid the market price, p∗ determined by market factor supply and factor demand

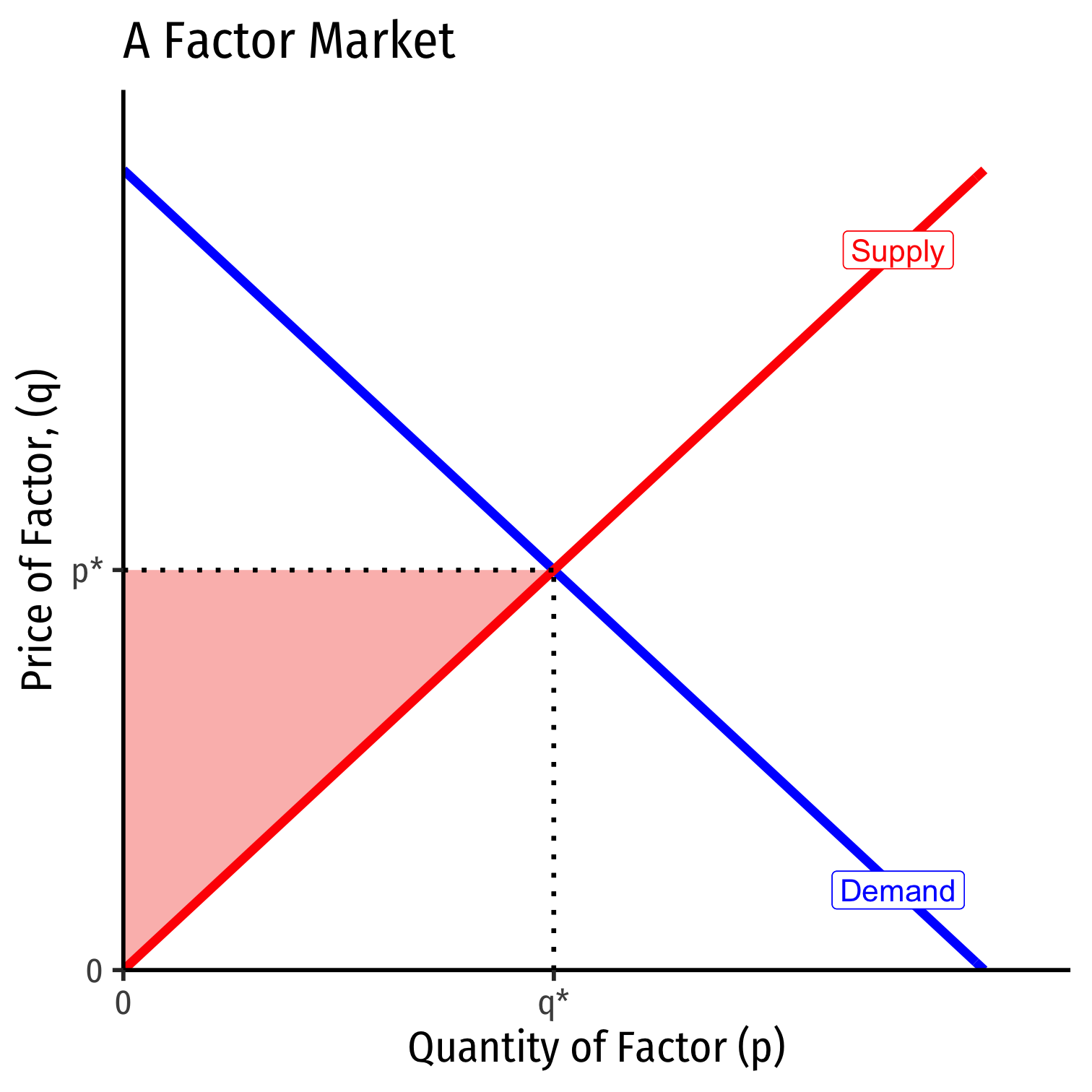

Factor Supply & Economic Rent I

Some factor owners would have accepted a job for less than p∗

Those owners earn economic rent in excess of what is needed to bring their factor into the market (its opportunity cost)

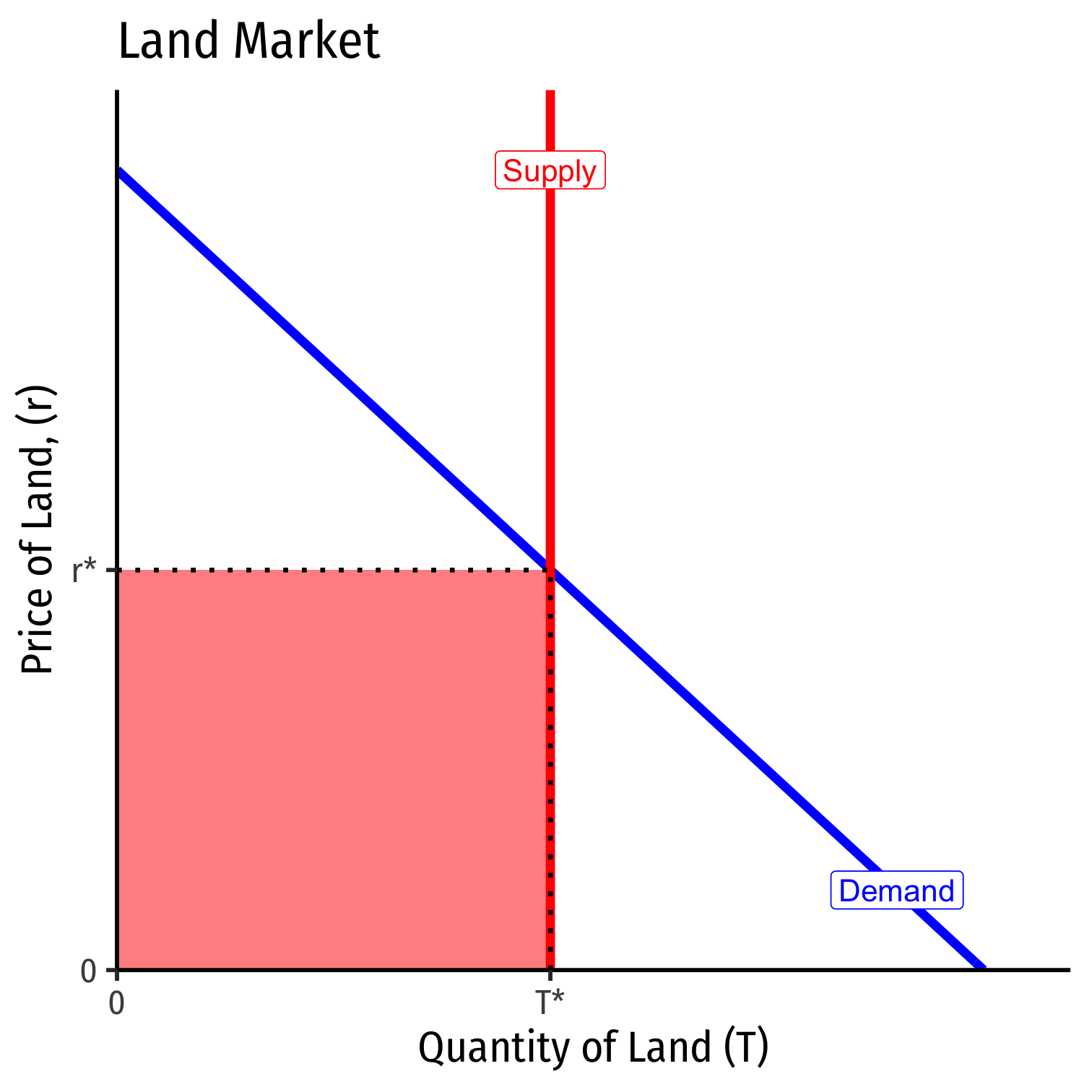

Factor Supply & Economic Rent II

Consider a factor (such as land) for which the supply is perfectly inelastic (e.g. a fixed supply)

Then the entire value of the land is economic rent!

The less elastic the supply of a factor, the more economic rent it generates!

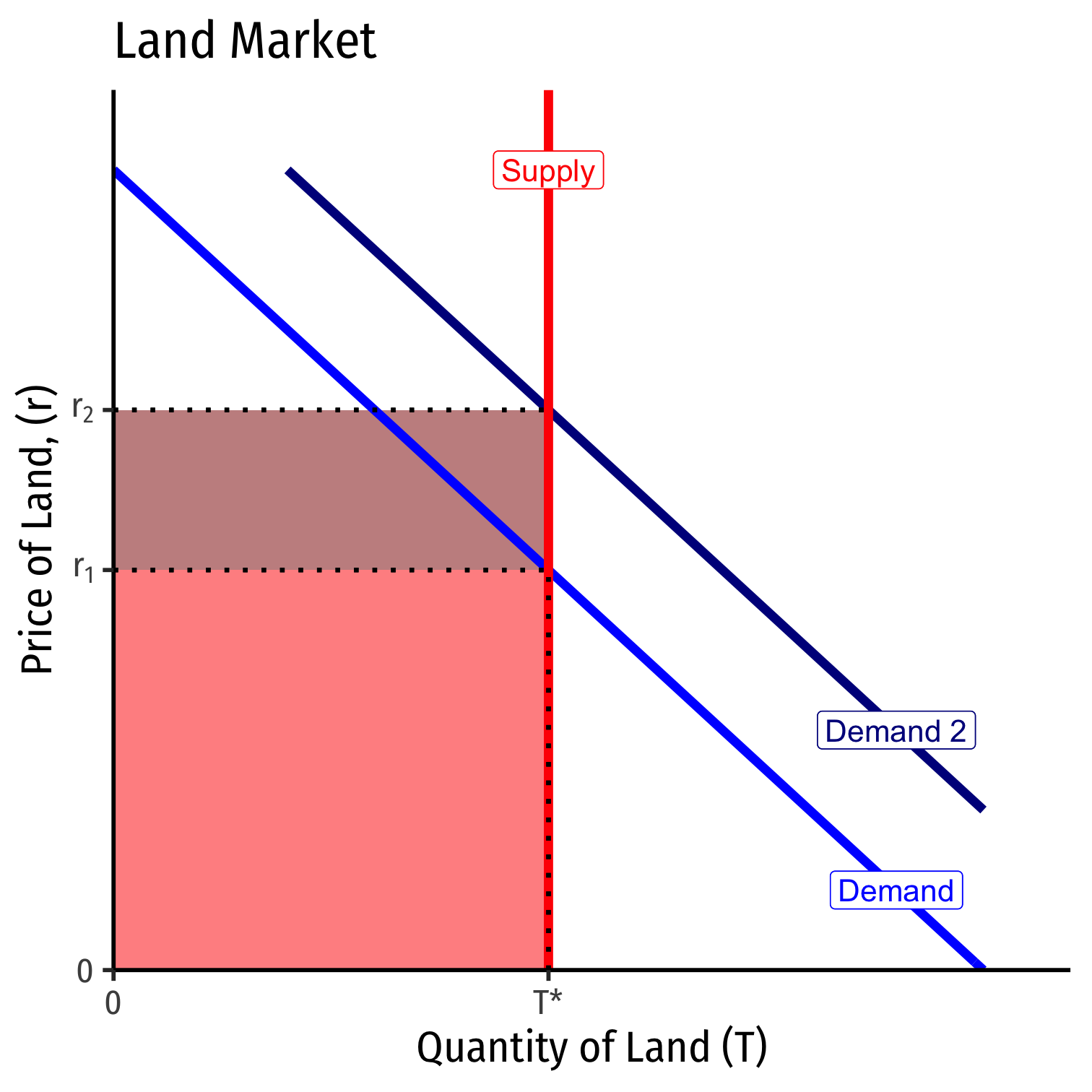

Factor Supply & Economic Rent II

An increase in demand raises the price of the factor, and creates more economic rents

Think of land during the industrial revolution

- Lazy landowners earn more income, don't need to sell to industrialists

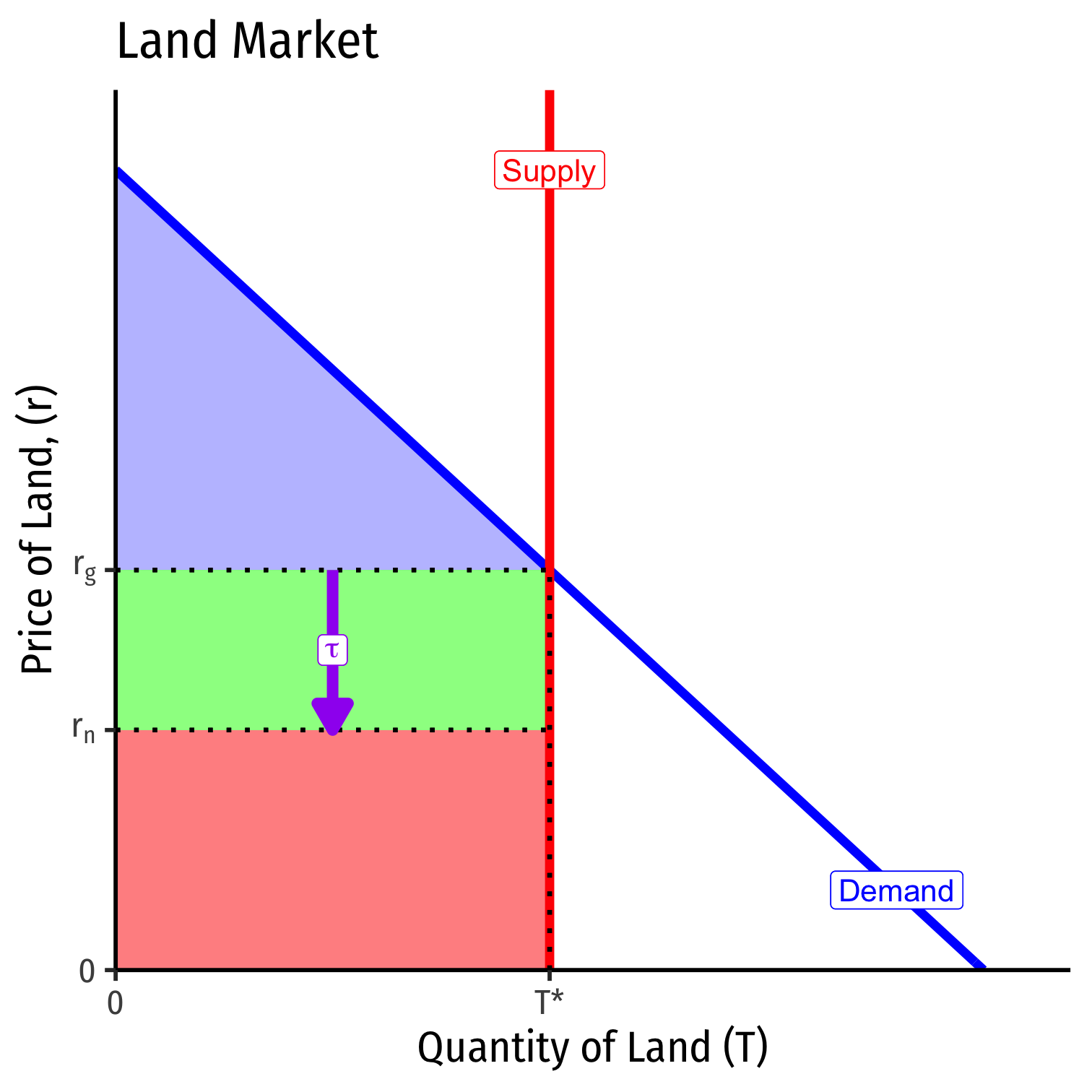

Tax on Land Value

A tax on land, τ, (if supply is perfectly inelastic) is not distortionary!

Gross price to buyers (rg) remains the same

Landowners bear the full economic incidence of he tax

No change in quantity, no Deadweight loss!

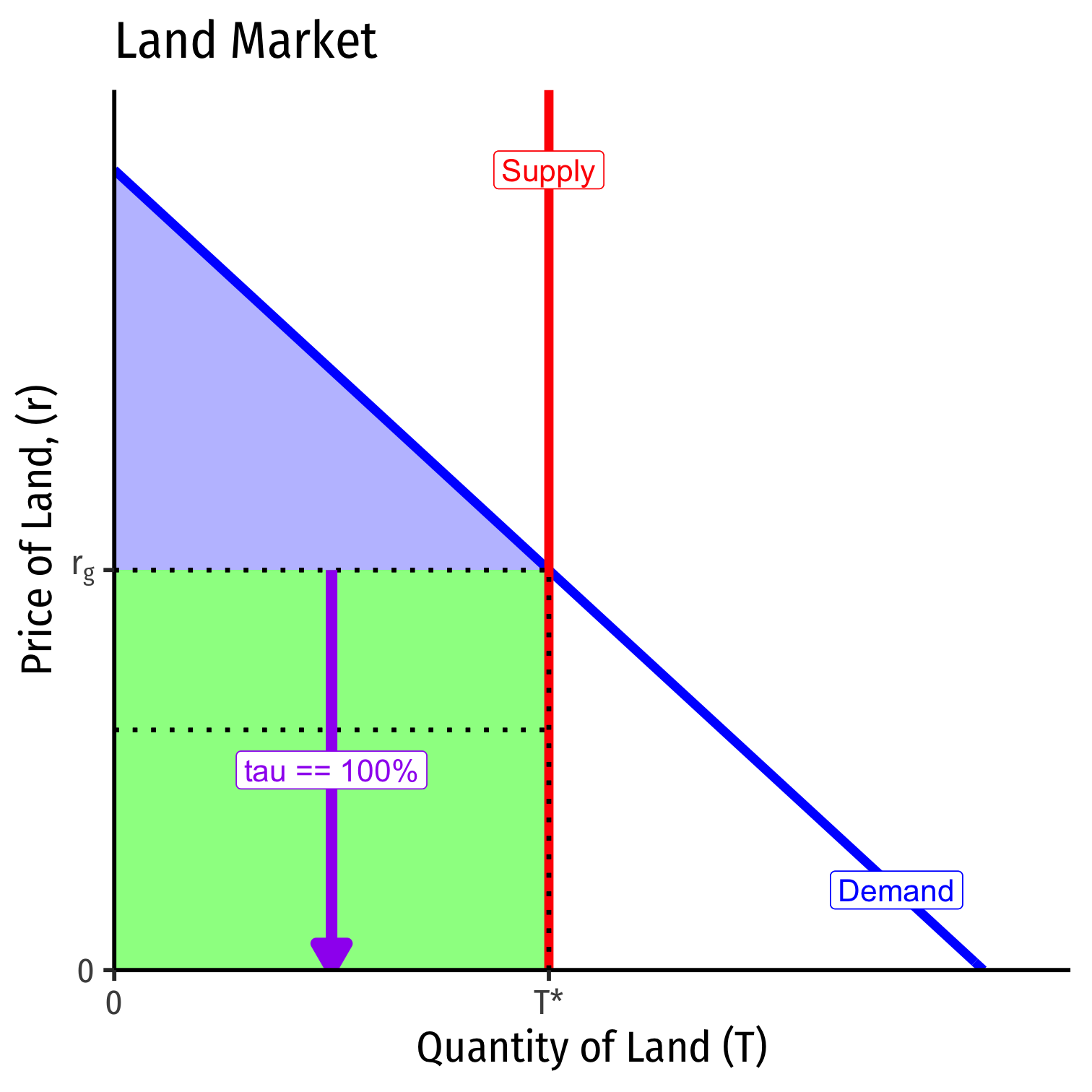

100% Tax on Land Value

A tax on land, τ, (if supply is perfectly inelastic) is not distortionary!

Gross price to buyers (rg) remains the same

Landowners bear the full economic incidence of he tax

No change in quantity, no Deadweight loss!

In the limit, a 100% tax on land

Problems with Georgism

Investment inefficiency: No incentive for occupants to invest in, or even care for, land they occupy

Tragedy of the commons: incentive to drain as much resources (minerals, vegetation, etc) from the land before it can be taxed

- environmental damage

Problems with Georgism

- An administrative nightmare: government assessors must distinguish between natural land (taxed) and artifical capital (untaxed)

- Artificial capital raises the value of land and land nearby (factories create neighborhoods, etc.)

- Land value of the empire state building?

From Common Ownership to Auctions

Auctions

"We laid out a fancificul version of this approach...all property - every factory, house, and car - is held in common and the right to rent and use it is constantly auctioned. The citizen who offers the highest bid (in the form of a rental payment) possesses the object until outbid by another citizen. Each factory, house, or car would have a standing highest bid placedo n it, representing the rent that the current possessor agreed to pay to the government for using the asset. Anyone could beat this bid and claim the object. The money collected from rents is used to finance public goods...and fund a social dividend," (p.49).

This Is Actually Practiced Already

1 Coase famously suggested this in 1959 in a famous article that contained the

seeds of the "Coase Theorem" before his famous 1960 paper.

Since 1994, Federal Communications Commission (FCC) auctions off electromagnetic spectrum licenses1

Problems: auctions are infrequent, winneres can (inefficiently) hold onto spectrum for decades

- Current occupant can hold out and refuse to sell to other firms who could use it better

Auctions and Investment Efficiency

Continual auctions create investment inefficiency

- Possessions can be taken at any time

If assets owned by the government (and only leased to user) then the higher bidder's bid goes to the government, not the current user

No incentive for user to invest to improve or maintain their assets

Allocative vs. Investment Efficiency

A tradeoff between allocative efficiency and investment efficiency

Use private property where investment efficiency more important

- Lose some allocative efficiency (people hang on to their possessions) but improve the assets

- George's "artifical capital"

Allocative vs. Investment Efficiency

Use common ownership where allocative efficiency more important

- Frequent trading of assets, but less incentive to improve them

- George's "natural land"

U.S. mostly follows this scheme:

- private ownership of most assets (land, cars, houses, personal effects)

- government owns many resources (most land in the West)

- government auctions off some resources (FCC spectrum)

Federally-Owned Land

Federally-Owned Land

Allocative vs. Investment Efficiency

Forcing property into either private or common gets one form of inefficiency

Posner & Weyl: balance with "Partial Common Ownership" to preserve both incentives

COST

A Harberger Tax

Arnold Harberger

1924-

"If taxes are to be levied...on...the value of properties...it is important that assessment procedures be adopted which estimate the true economic value...The economist's answer...is simple and essentially fool-proof: allow each...owner...to declare the value of his property, make the declared values...public, and require that an owner sell his property to any bidder...willing to pay...the declared value. This system is simple, self-enforcing, allows no scope for corruption, has negligible cost of administration, and creates incentives, in addition to those already present in the market, for each property to be put to that use in which it has the highest economic productivity," (p.57).

Quoted in Posner, Eric and E. Glen Weyl, 2017, Radical Markets

COST

Posner & Weyl: a "Common Ownership Self-Assessed Tax" (COST)

- also, the "cost" of holding wealth

If tax is set approximately equal to the turnover rate, an owner wishing to change the self-assessed price of her asset:

- benefit is equal to tΔP (to deter a buyer)

- cost is equal to tΔP (have to pay tax on price)

- has incentive to bid their true valuation

Maximizes allocative efficiency

- Only buyers with higher WTP will buy assets from owners

COST

Recall: property rights as a bundle of sticks

Under COST, an owner is given right to use, and (partial) right to exclude

- Cannot exclude a higher bidder!

A Sociey of Partial-Renters

"We can conceptualize a COST as sharing ownership between society and the possessor. Possessors become lessees from society. Their lease terminates when a higher-value user appears, whereupon the lease is automatically transferred to that user," (p.72).

COST is Not Central Planning

"Yet this is not central planning. The government does not set prices, allocate resources, or assign people jobs...[t]he government's role would become more limited than it is today because there would be no need for discretionary interventions, like eminent domain or public ownership of property in the conventional sense, to solve holdout and other monopoly-related problems. There would be much less need for distortionary and discretionary government taxes to raise revenue for the state. Furthermore, control of everything would be radically decentralized...Far from creating a form of centralized planning, the COST creates a new kind of market - a flexible market in uses, to replace the old market based on permanent ownership," (p.72).

Practical Implementation of COST

"Every individual and business would have to list each of their possessions in a public register hosted on an online application and enter valuations for each item - or accept default valuations based on the original purchase price or on a database of prices of used goods (like today's Blue Book for used cars) - and would pay an annual tax based on the time-average price they listed over the course of the year. These lessees could change their valuations at any time...," (p.73).

Practical Implementation of COST

"Anyone interested in acquiring ('posessing') a specific good would search the databased to find local items of interest. Barcode scanning or photographic recognition software would display the price of something in front of you. By clicking on the item, you transfer funds from your bank account into escrow, and the funds would then bee deposited to the current possessor's account on delivery of the asset. Nondelivery would be penalized as theft," (p.73).

Benefits of a COST

"As we noted above, the economy underperforms by as much as 25% annually because of the misallocation of resources to low productivity firms. A fully implemented COST could increase social wealth by trillions of dollars every year. Moreover, a COST would raise substantial revenue. At the rate of roughly 7% annually that we imagine being near optimal, a COST would raise roughly 20% of national income. About half of that money would suffice to eliminate all existing taxes on capital, corporations, property, and inheritance, which economists agree are highly inefficient...[and] to wipe out the budget deficit and significantly reduce debt...

Benefits of a COST

"The other half of COST revenue would be roughly $3,500 per person in the United States...and almost certainly would skyrocket...because of the more efficient allocation of assets...These funds could be used to finance government services, public goods...or social welfare programs for the poor. One could also imagine a system in which the revenue generated by the COST is simply sent back to the population on a per capita basis as a social dividend - akin to the universal basic income, which is currently being touted by leading commentators. In this form, a COST would also serve as a much more effective way to collect a tax on wealth...," (p.80).