4.4: Taxation

ECON 410 · Public Economics · Spring 2020

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/publics20

publicS20.classes.ryansafner.com

Motivation and Types of Taxation

Motivation for Taxation

Most basic power of the State is the power to tax

Often two types of reasons for a tax:

- Raise revenue for the provision of public goods and transfers

- Discourage or encourage certain behaviors and transactions

Taxes thus have two effects:

- Generate tax revenue

- Distort individual incentives

Types of Taxation

Taxes on Income:

- Individual income tax on income (of all sorts) over a year

- Payroll tax on wage income earned at a job

- Captal gains tax on net value from selling capital assets (e.g. stocks, paintings, houses)

- Corporate income tax on net income of corporations

Types of Taxation

Taxes on Wealth

- Wealth tax on value of owned assets

- Property tax on value of real estate (land plus structures)

- Estate tax on value of estate (assets) left behind when one dies

Types of Taxation

Taxes on Consumption:

- Sales tax on all goods and services at point of sale

- Excise tax on particular goods and services

- Tariff tax on imports (and sometimes exports)

Types of Taxation

Incidence of Taxation

Incidence of Taxation

Economists focus on the incidence of taxation: how does a tax change behavior and affect welfare?

A tax imposes a statutory burden on party legally required to pay the tax

This does not directly translate to the economic burden, who actually bears the incidence of the tax

Economic vs. Statutory Incidence

Economic and statutory burdens are not the same thing!

Parties may be able to alter their behavior to avoid or shift it onto others

- Businesses may pass higher prices onto consumers

- Consumers can switch to lesser-taxed substitutes (including nothing)

- People may move their wealth into lesser-taxed assets or jurisdictions

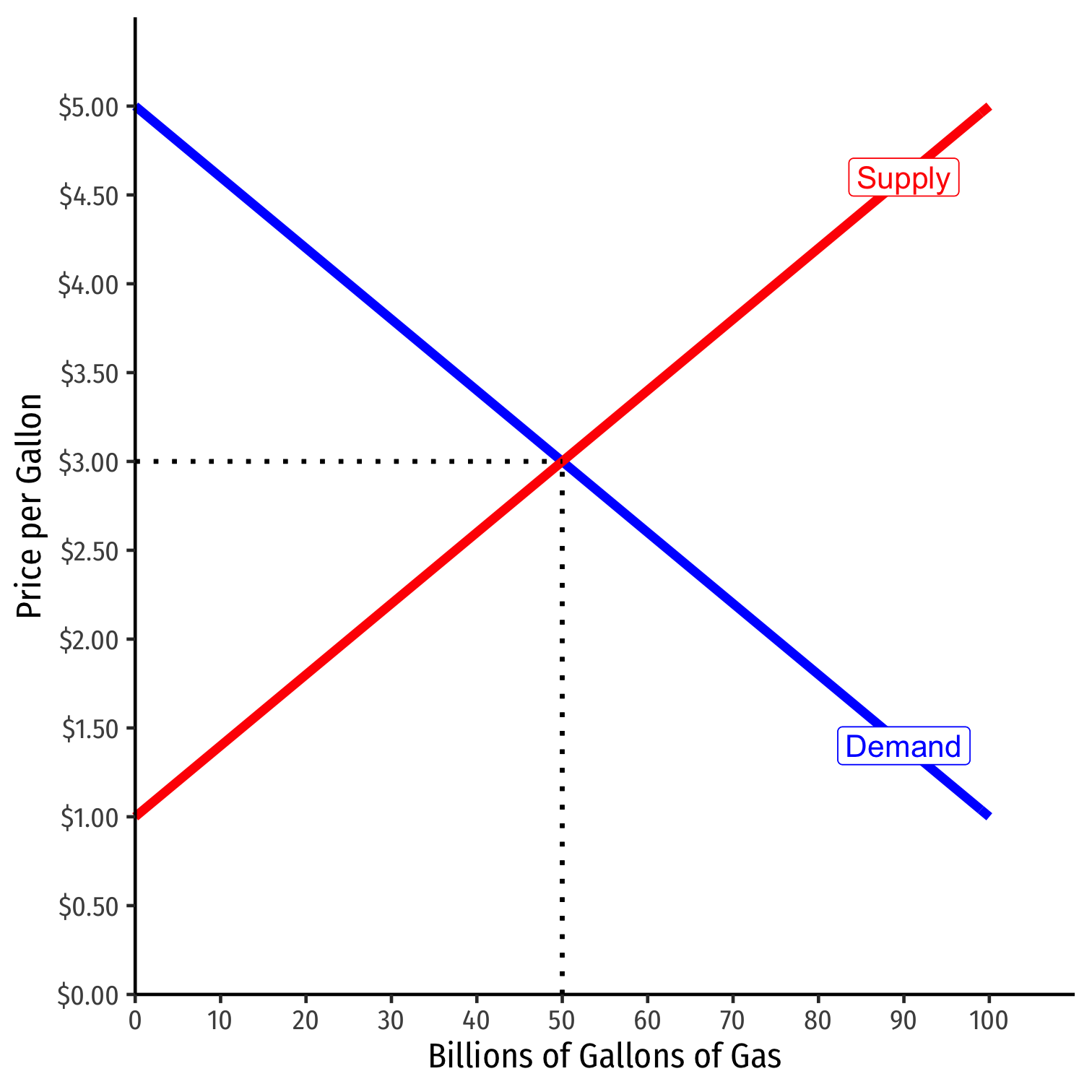

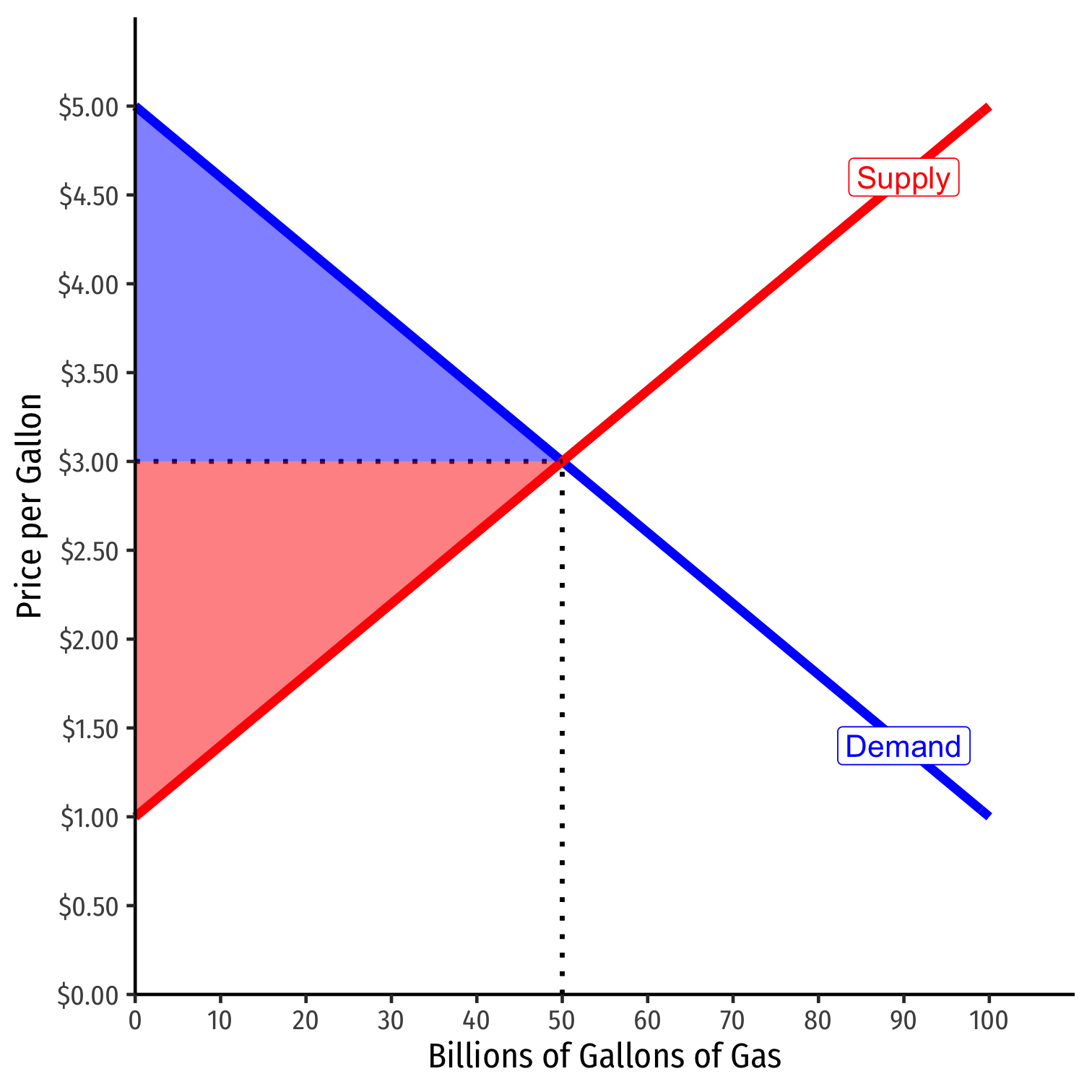

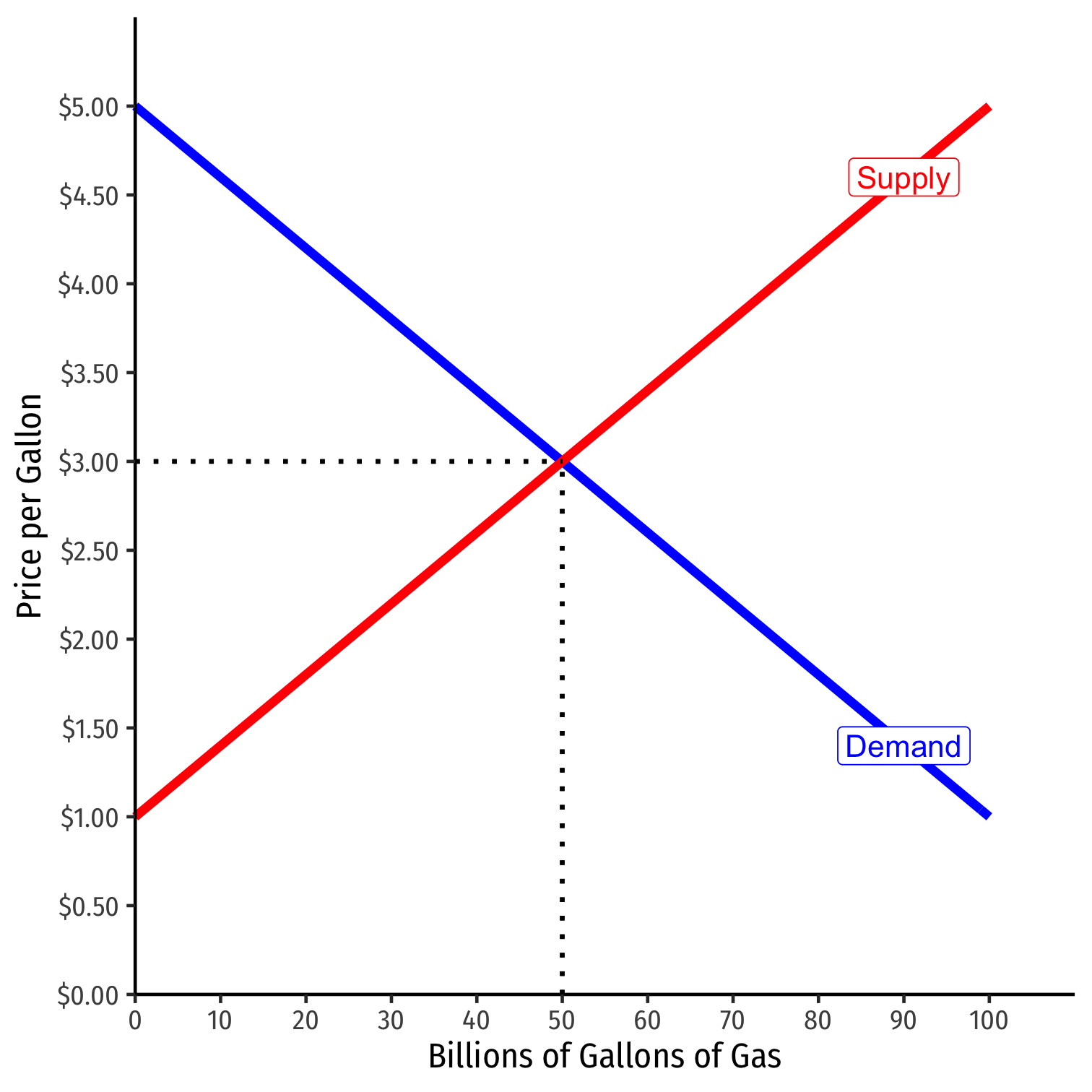

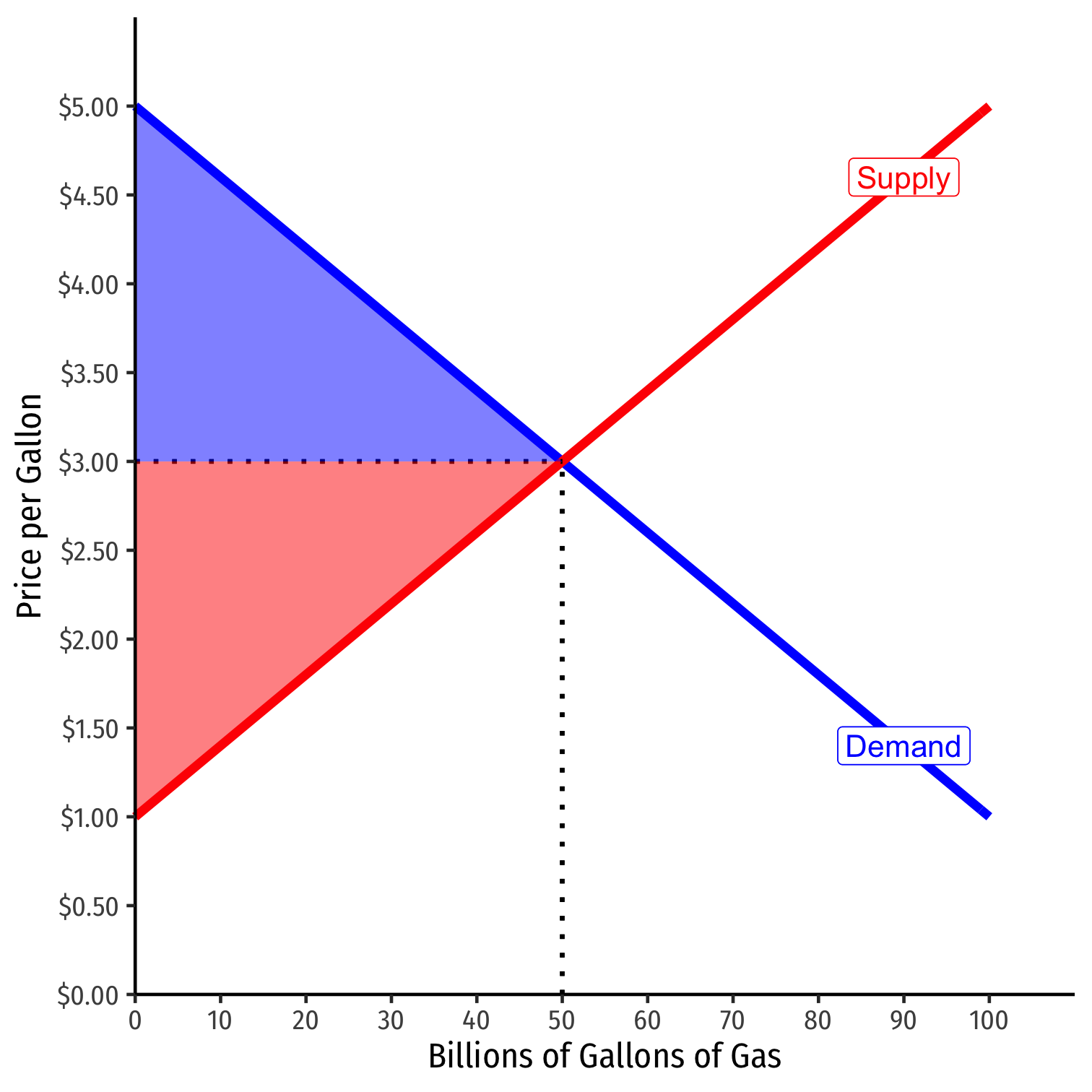

Example: An Excise Tax on Gasoline

- Gasoline market in equilibrium

- qd=qs= 50 billion gallons

- p = $3.00/gallon

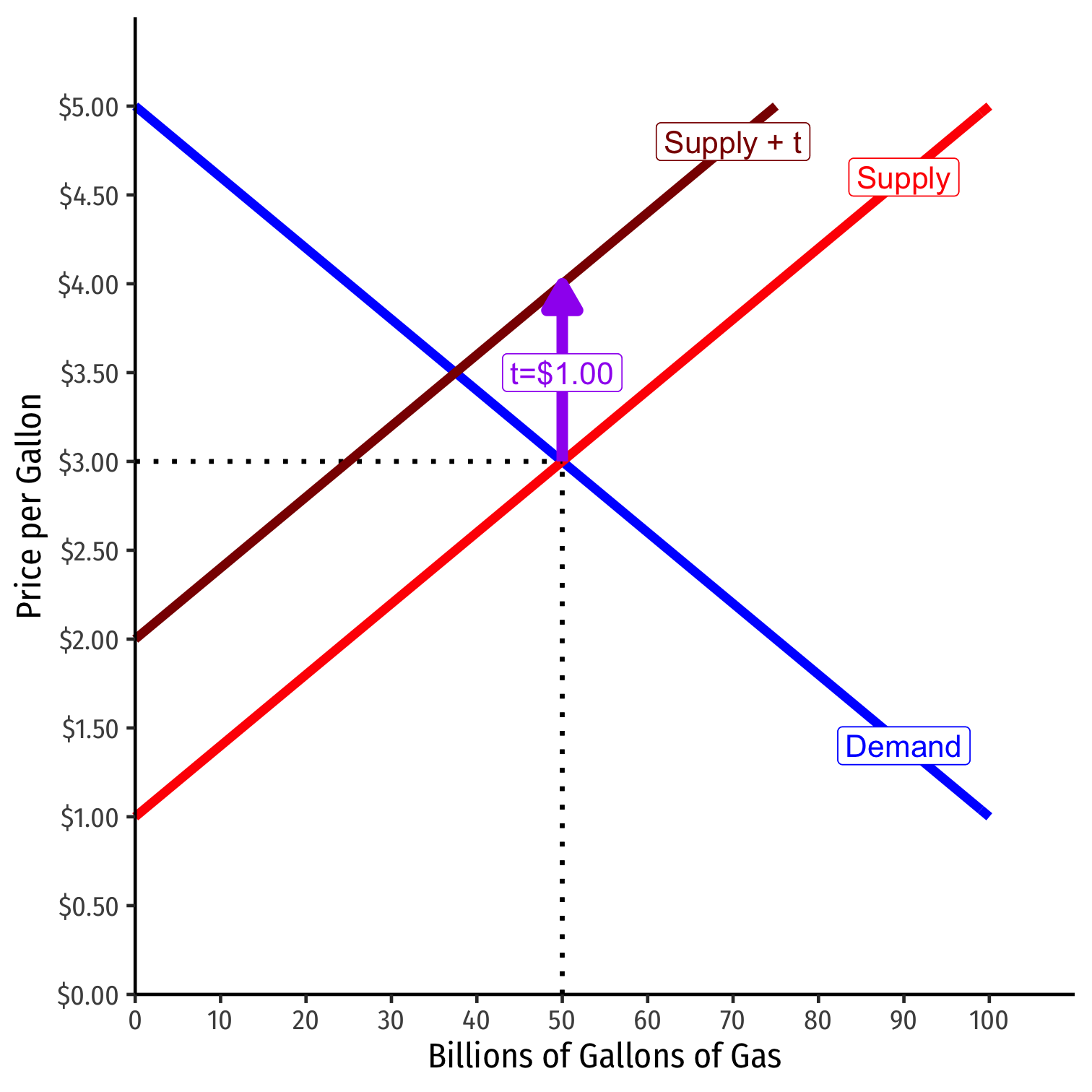

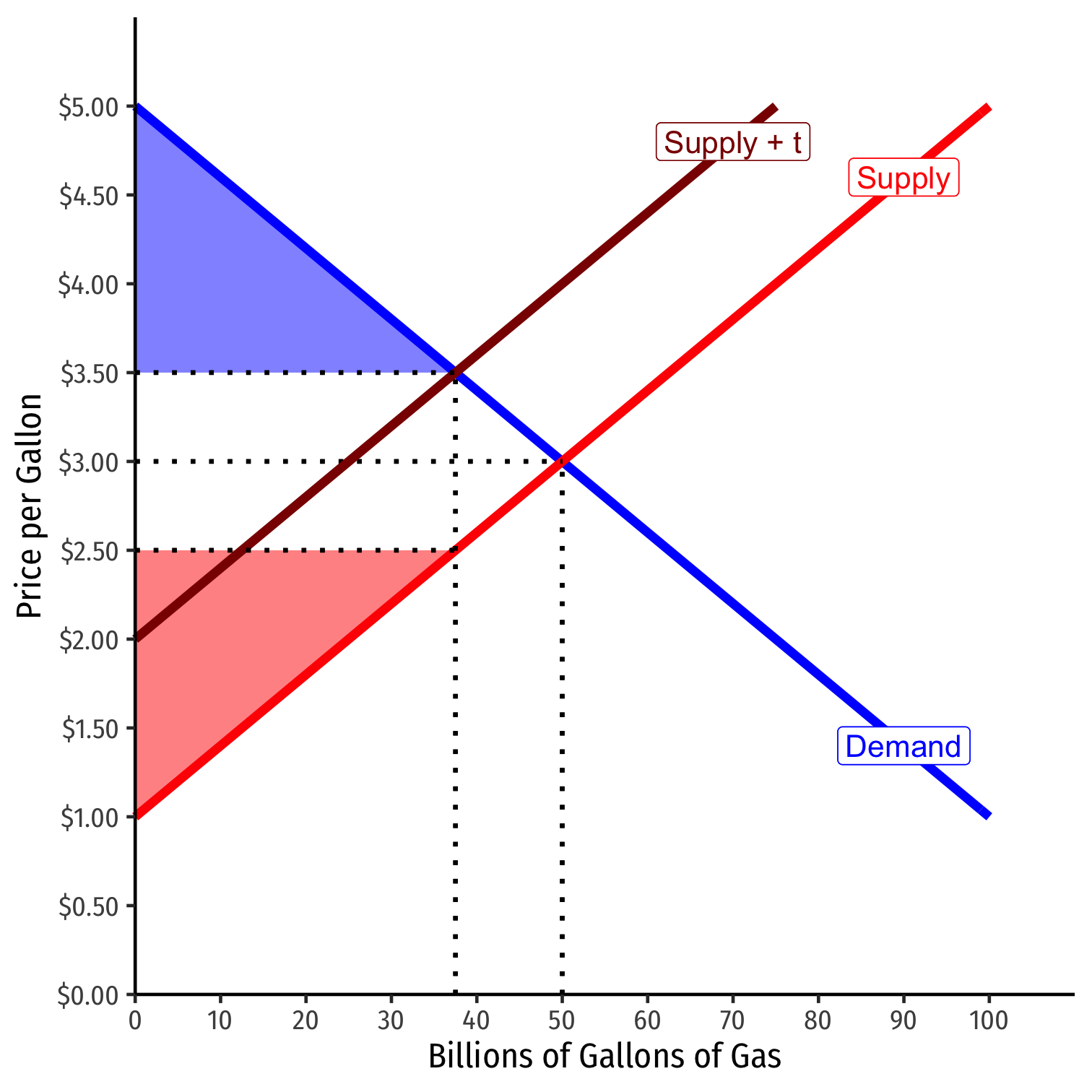

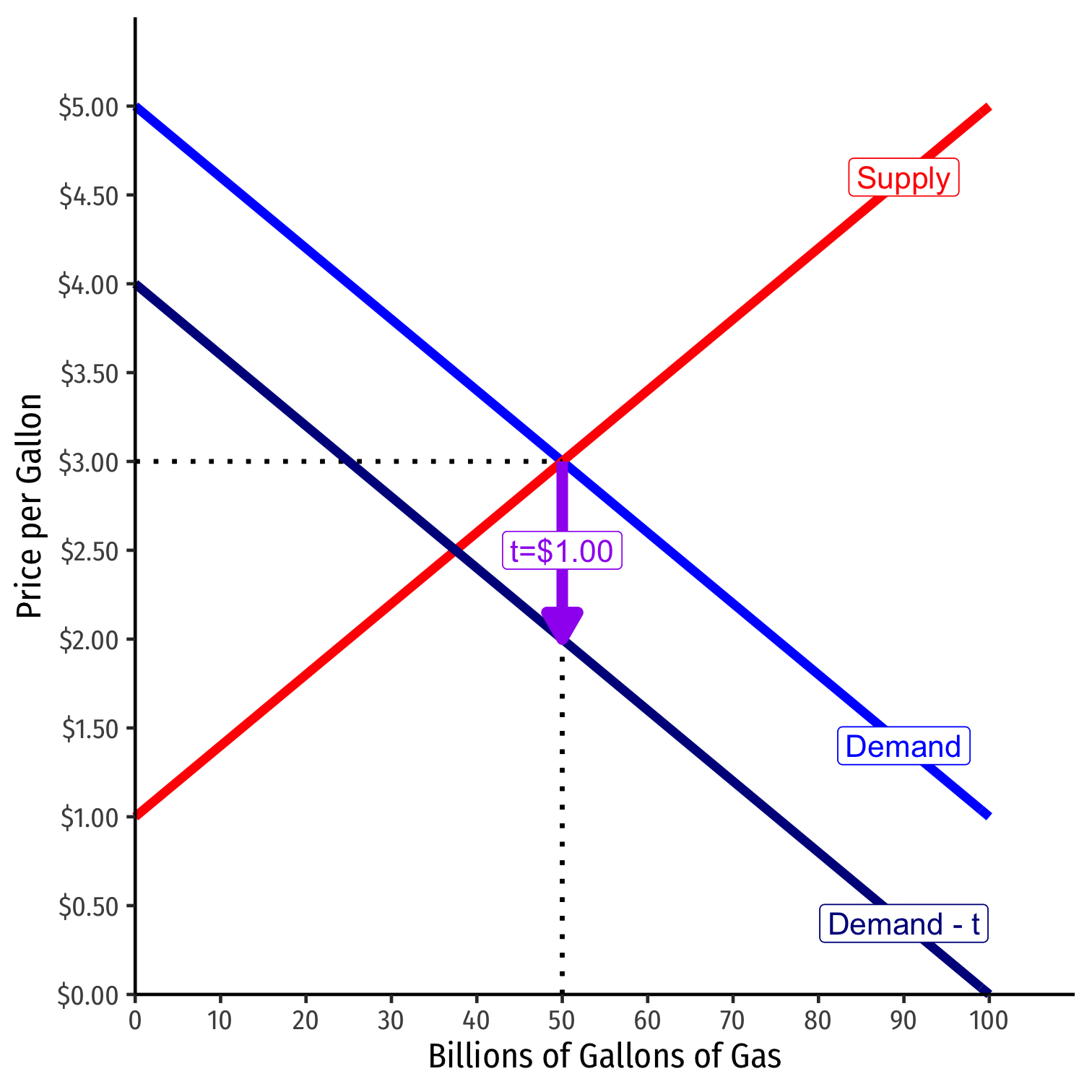

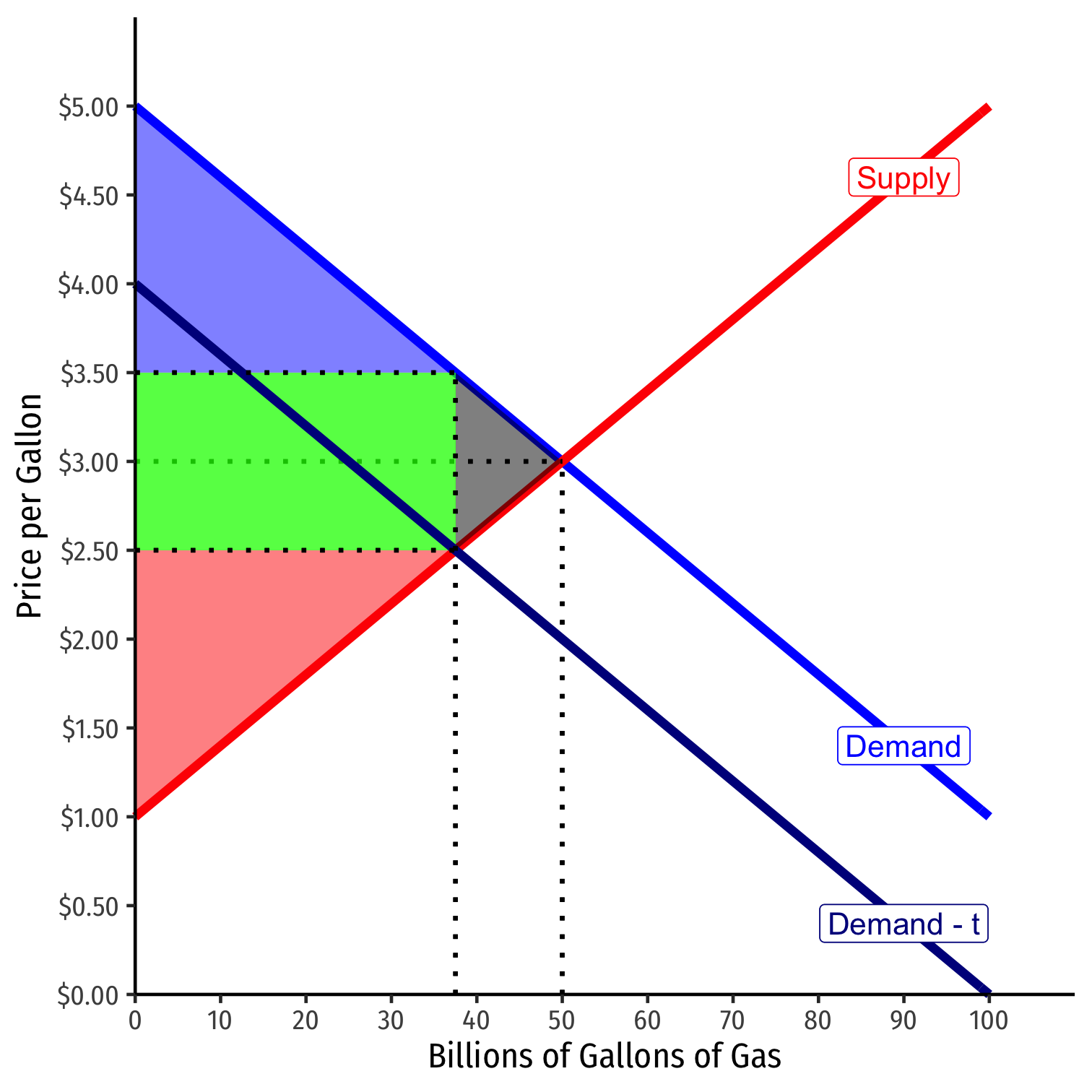

Example: An Excise Tax on Gasoline

Gasoline market in equilibrium

- qd=qs= 50 billion gallons

- p = $3.00/gallon

Suppose the government levies a $1.00 tax on suppliers

- Supply shifts up by $1.00

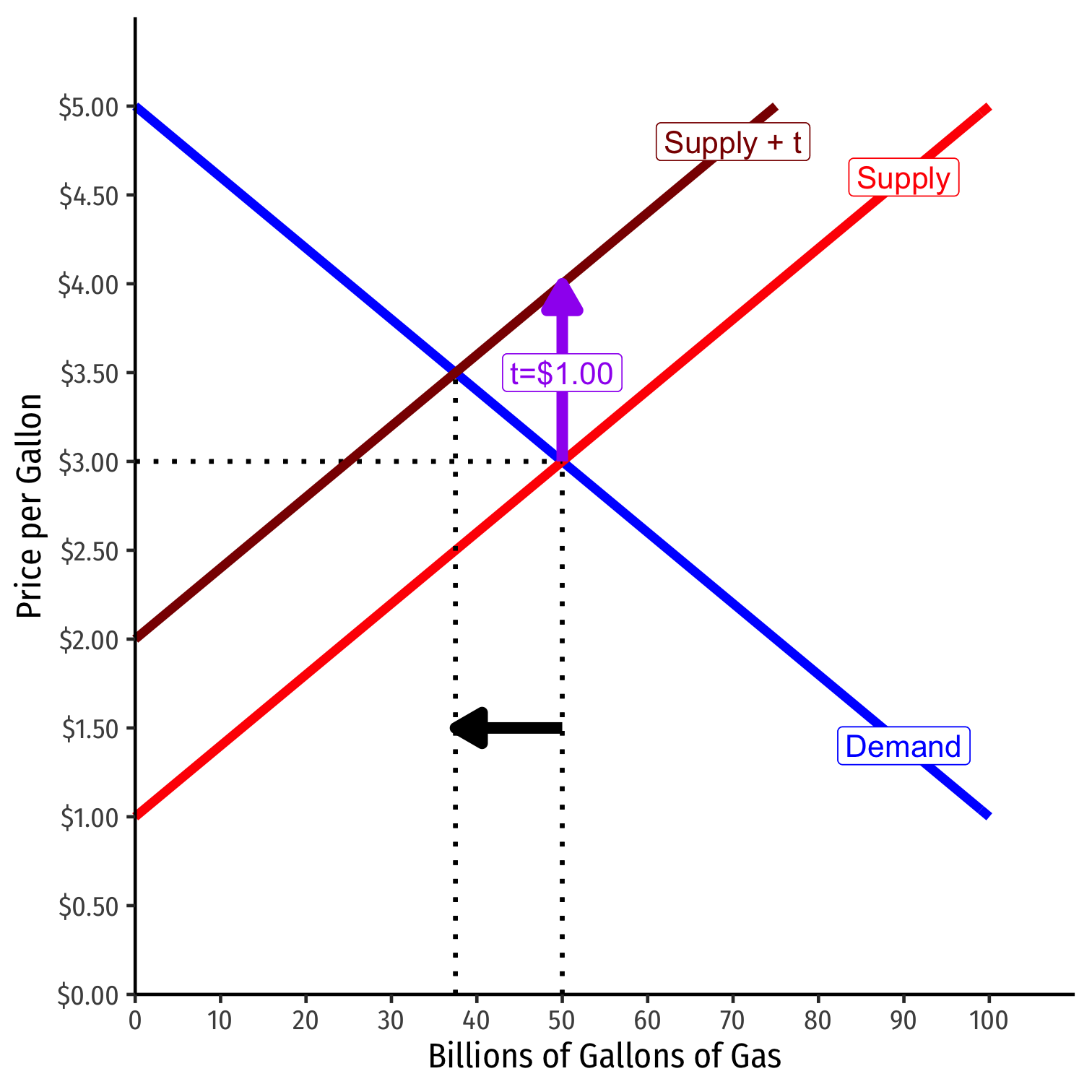

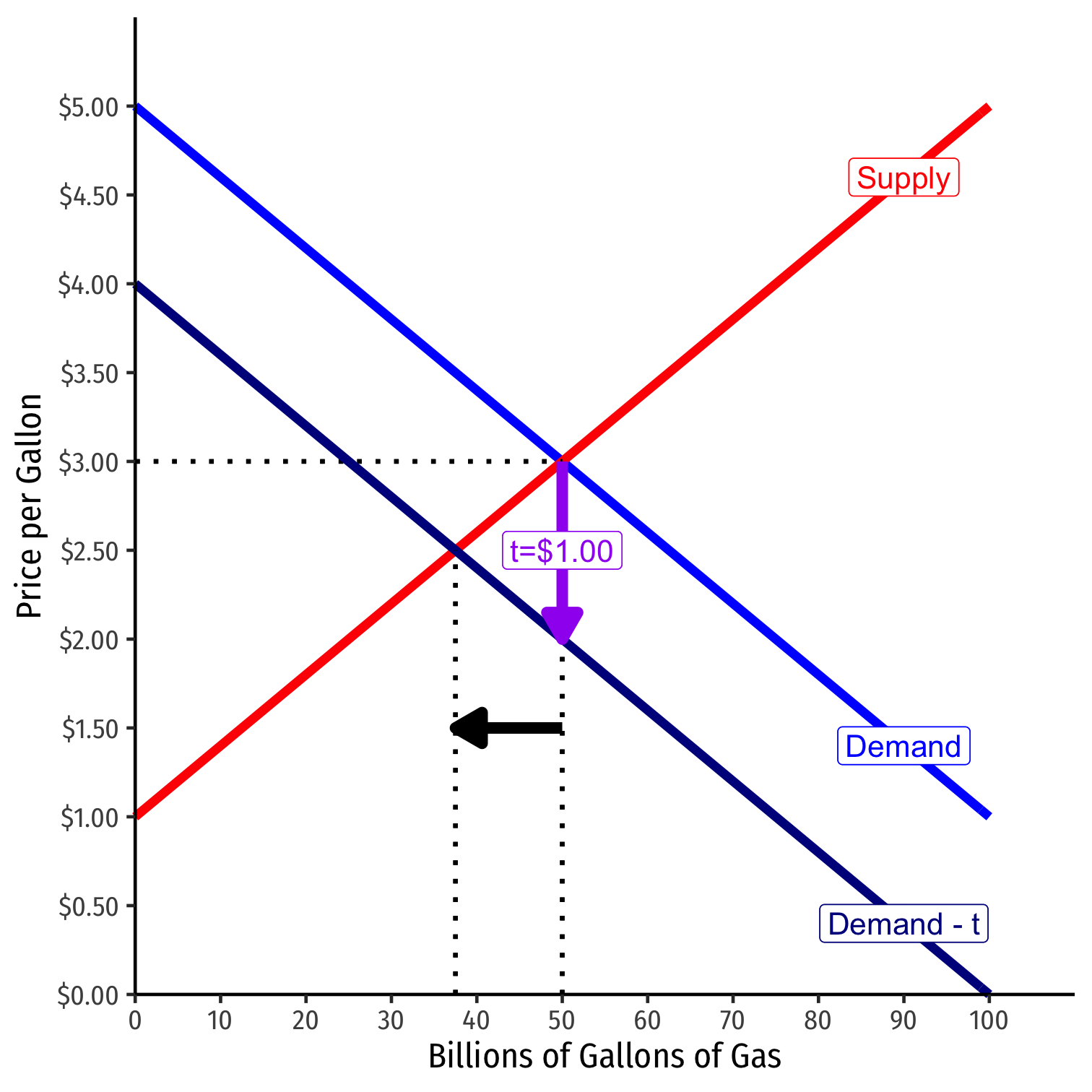

Example: An Excise Tax on Gasoline

Gasoline market in equilibrium

- qd=qs= 50 billion gallons

- p = $3.00/gallon

Suppose the government levies a $1.00 tax on suppliers

- Supply shifts up by $1.00

Qt decreases to 37.5

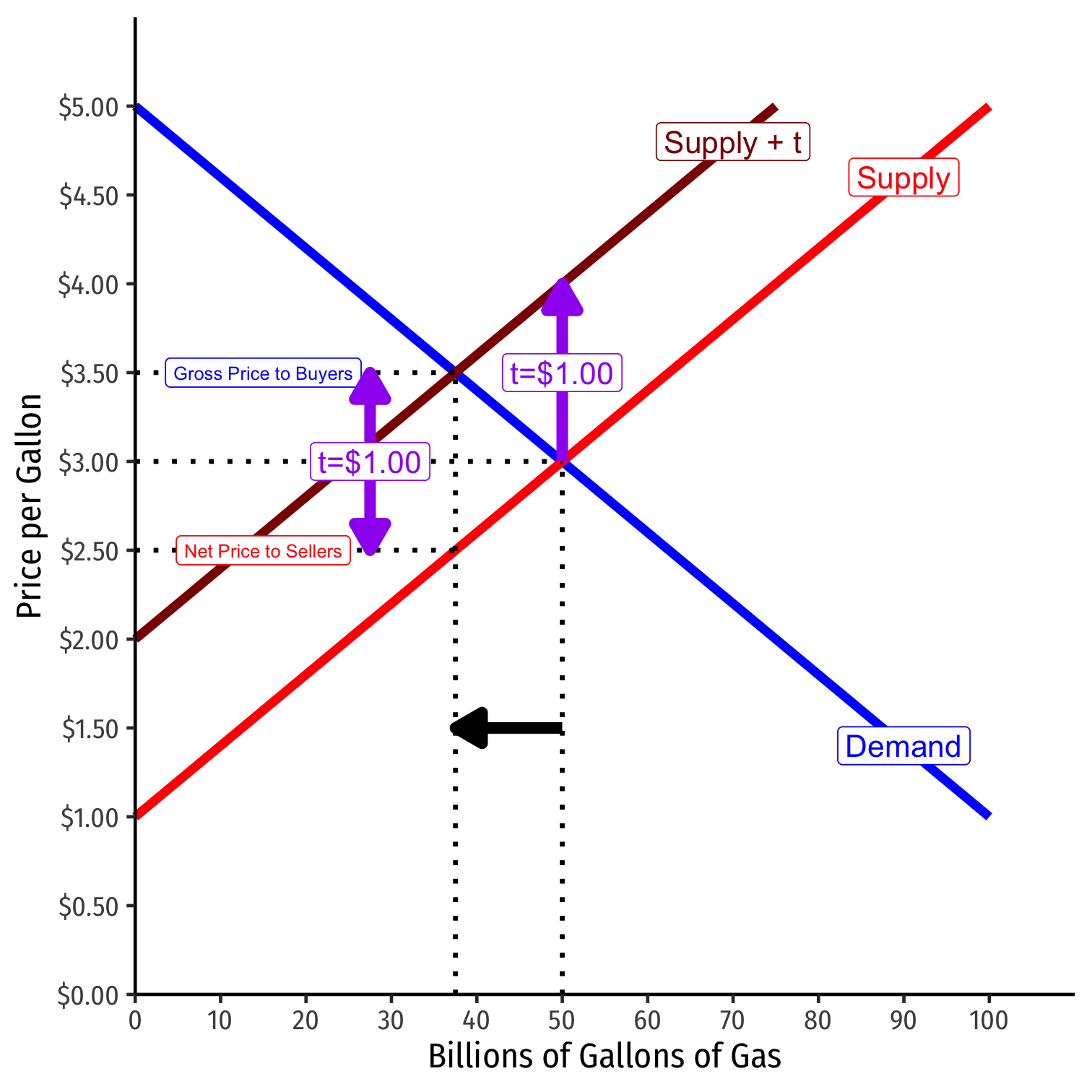

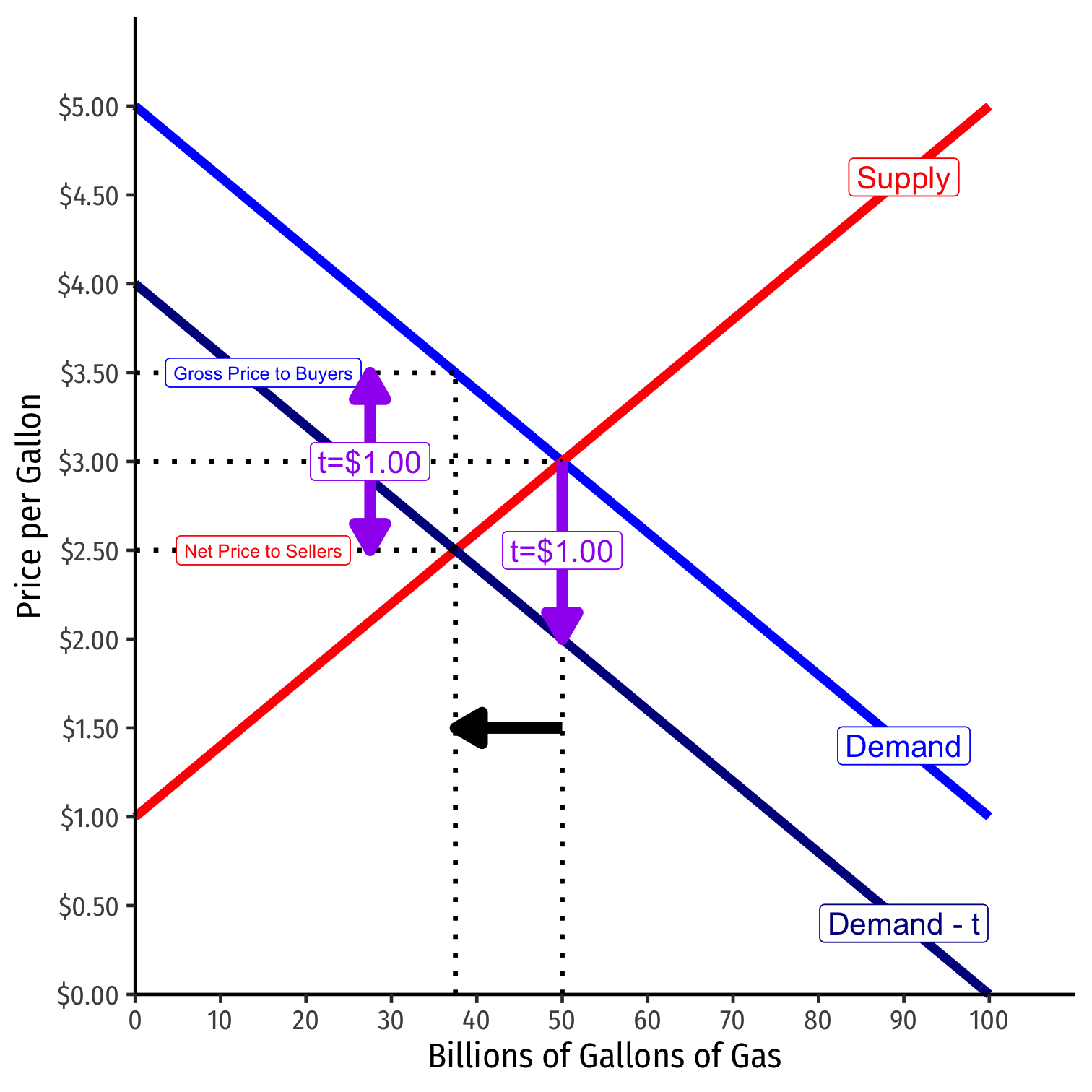

Example: An Excise Tax on Gasoline

Two relevant prices now:

$3.50: Gross price buyers pay (with tax)

$2.50: Net price sellers receive (after tax)

Difference between the two is the $1.00 tax!

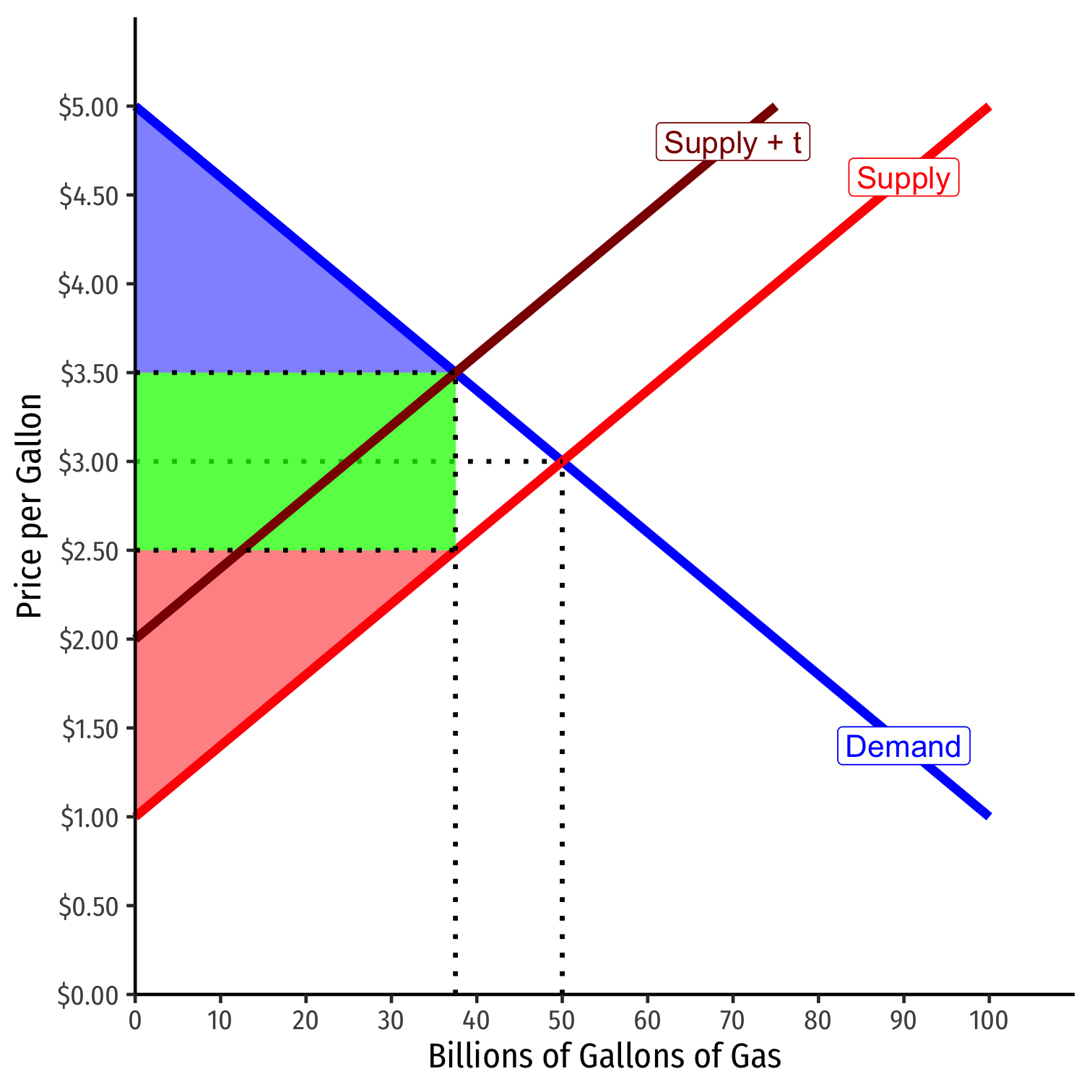

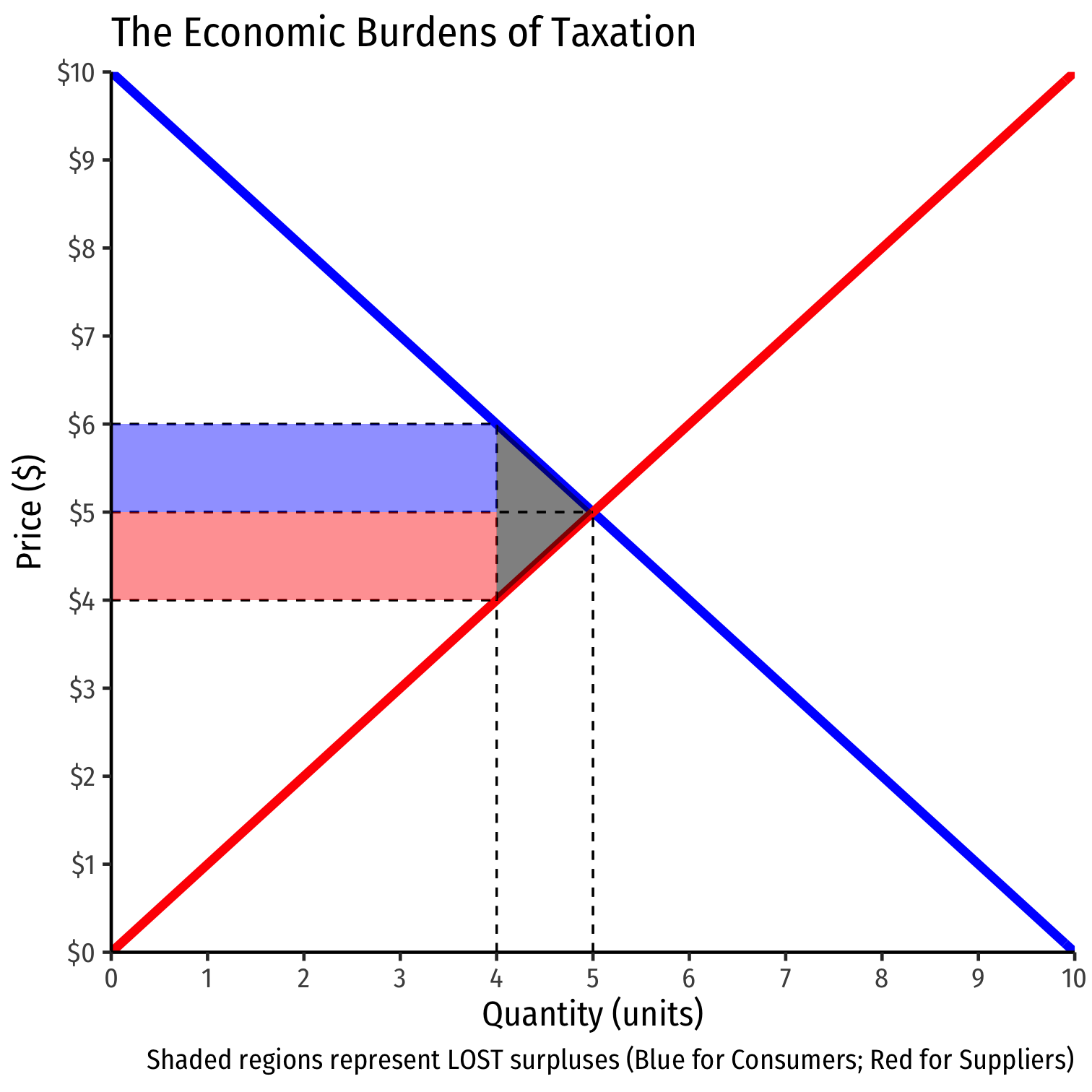

Example: Efficiency & Welfare Effects

Now we examine the efficiency and welfare effects of the tax with some comparative statics

Start with the pre-tax market equilibrium

- Consumer surplus

- Producer surplus

Example: Efficiency & Welfare Effects

Post-tax market equilibrium:

Consumer surplus decreases

- Buyers pay higher price for fewer gallons

Producer surplus decreases

- Sellers receive lower price for fewer gallons

Example: Efficiency & Welfare Effects

Post-tax market equilibrium:

Consumer surplus decreases

- Buyers pay higher price for fewer gallons

Producer surplus decreases

- Sellers receive lower price for fewer gallons

Tax revenue to government

- RG=t×qt

- Transfers from consumers and producers to government

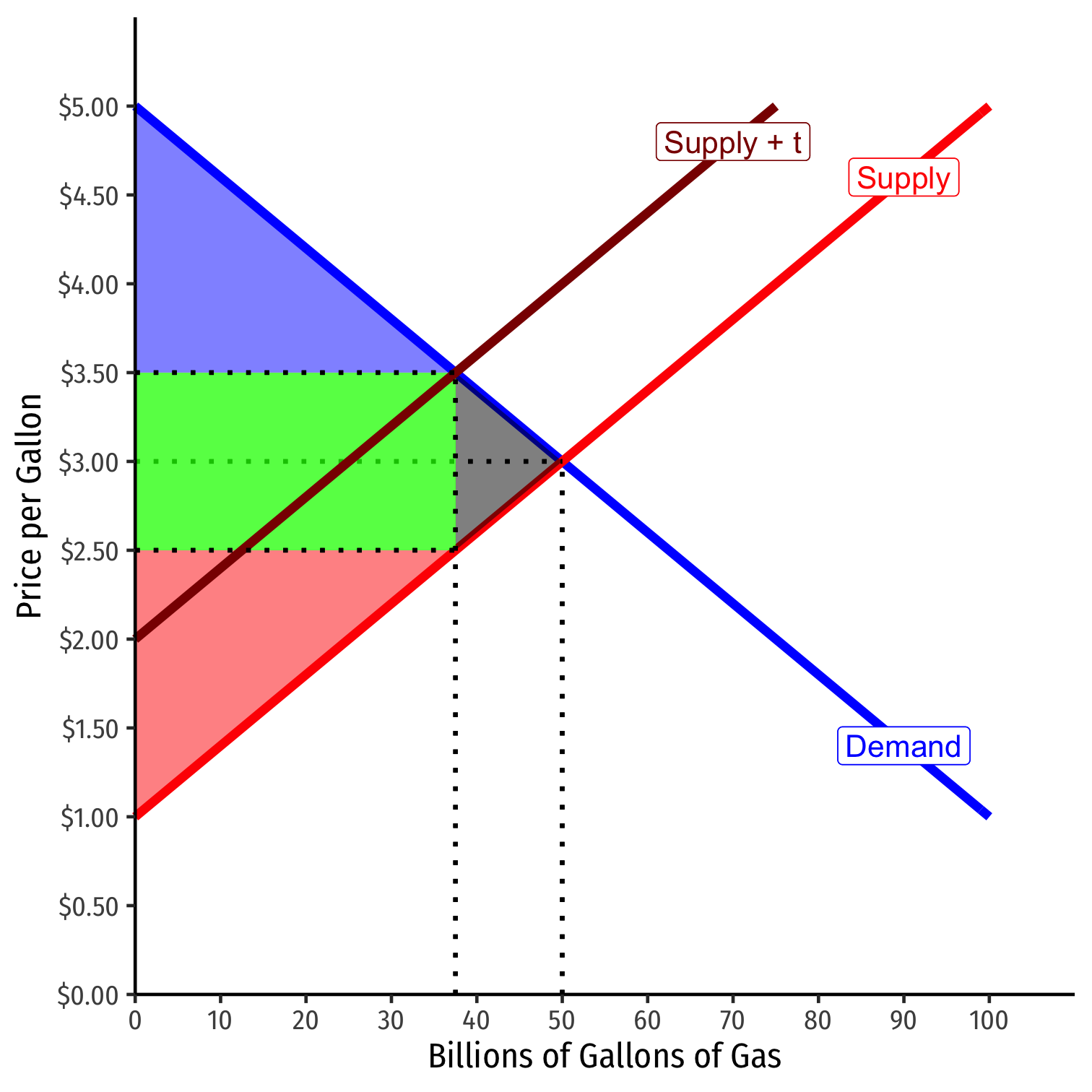

Example: Efficiency & Welfare Effects

Post-tax market equilibrium:

Deadweight Loss (DWL)

- Surplus that existed pre-tax that is now wasted

- Gains from exchange between willing buyers and sellers that is now made impossible

This is the true social cost of a tax

- Tax revenues are just a transfer, changes the distribution of surplus, but it still exists (going to someone)

- DWL destroys pre-existing surplus

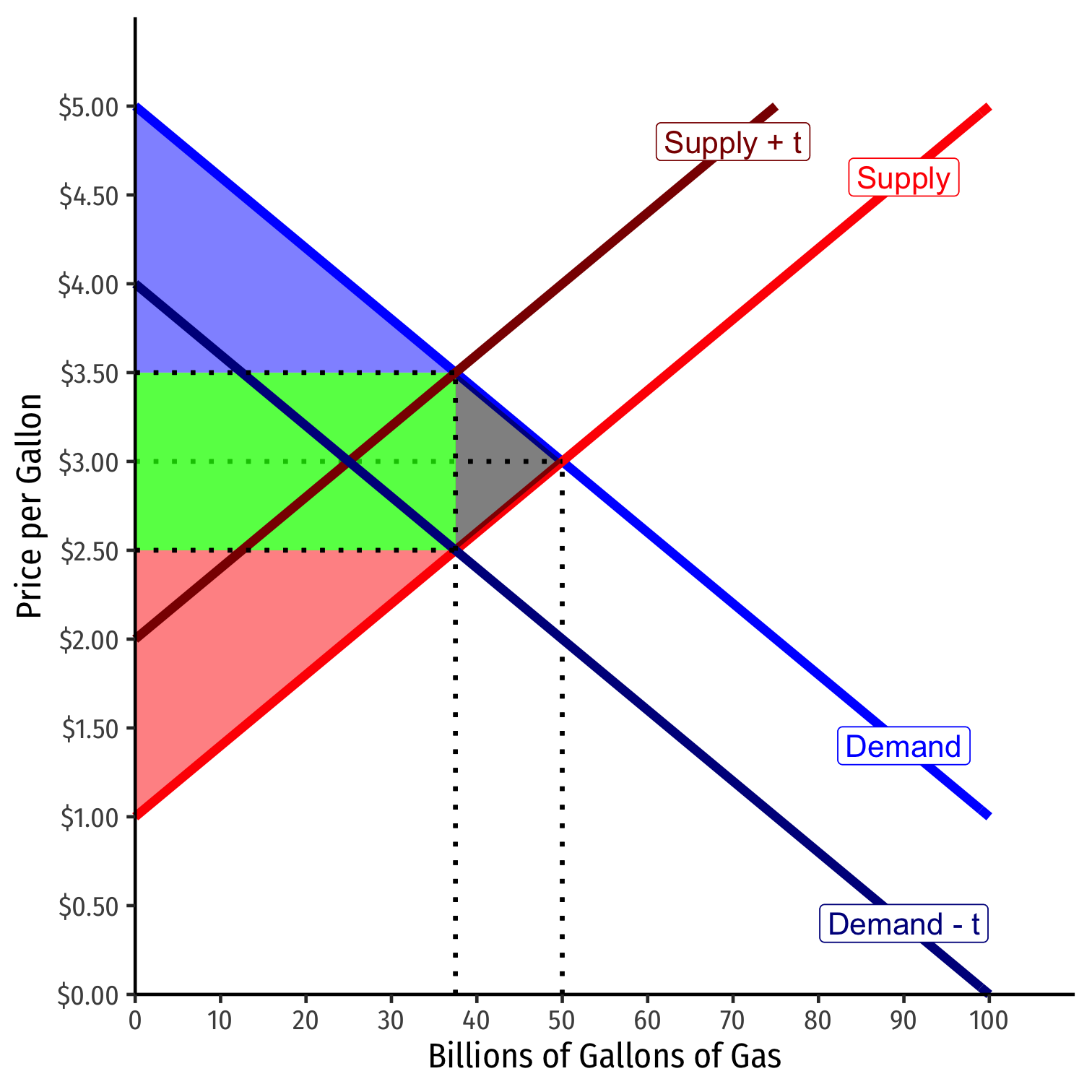

Example: An Excise Tax on Gasoline

- Gasoline market in equilibrium

- qd=qs= 50 billion gallons

- p = $3.00/gallon

Example: An Excise Tax on Gasoline

Gasoline market in equilibrium

- qd=qs= 50 billion gallons

- p = $3.00/gallon

Suppose the government levies a $1.00 tax on consumers

- Demand shifts down by $1.00

Example: An Excise Tax on Gasoline

Gasoline market in equilibrium

- qd=qs= 50 billion gallons

- p = $3.00/gallon

Suppose the government levies a $1.00 tax on consumers

- Demand shifts down by $1.00

Qt decreases to 37.5

Example: An Excise Tax on Gasoline

Two relevant prices now:

$3.50: Gross price buyers pay (with tax)

$2.50: Net price sellers receive (after tax)

Difference between the two is the $1.00 tax!

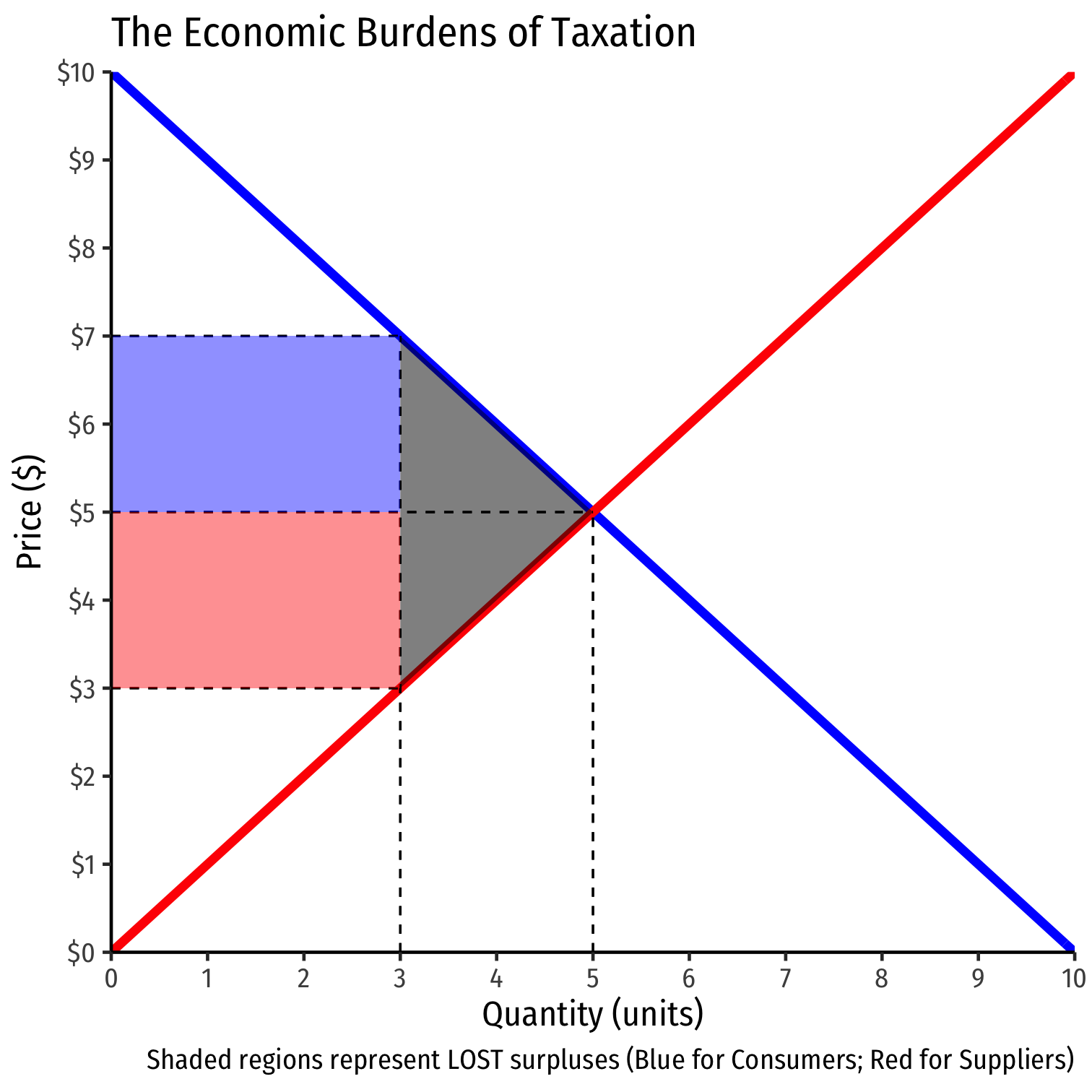

Example: Efficiency & Welfare Effects

- Start with the pre-tax market equilibrium

- Consumer surplus

- Producer surplus

Example: Efficiency & Welfare Effects

Exact same post-tax market equilibrium:

Consumer surplus decreases

Producer surplus decreases

Tax revenue to government

Surplus lost to Deadweight loss

Example: Efficiency & Welfare Effects

The statutory burden is irrelevant!

Placing the tax on Suppliers or on Demanders resulted in the same economic incidence of the tax!

Statutory Burden vs. Economic Incidence

The statutory burden is irrelevant!

Individuals may shift burden onto others until the same equilibrium is reached

- Relative price elasticities actually determine the distribution of the economic incidence between consumers & producers

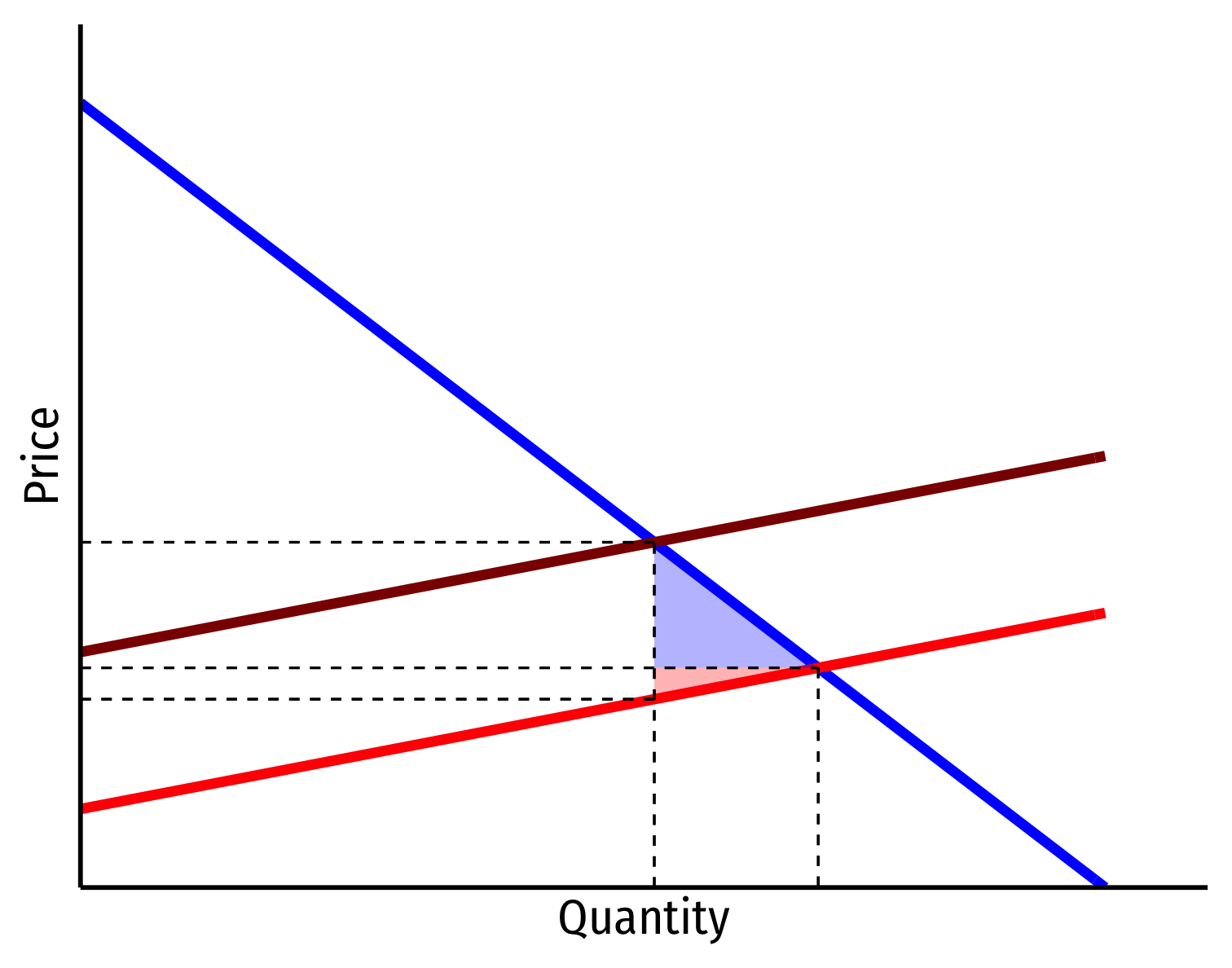

Relative Price Elasticities and Economic Incidence

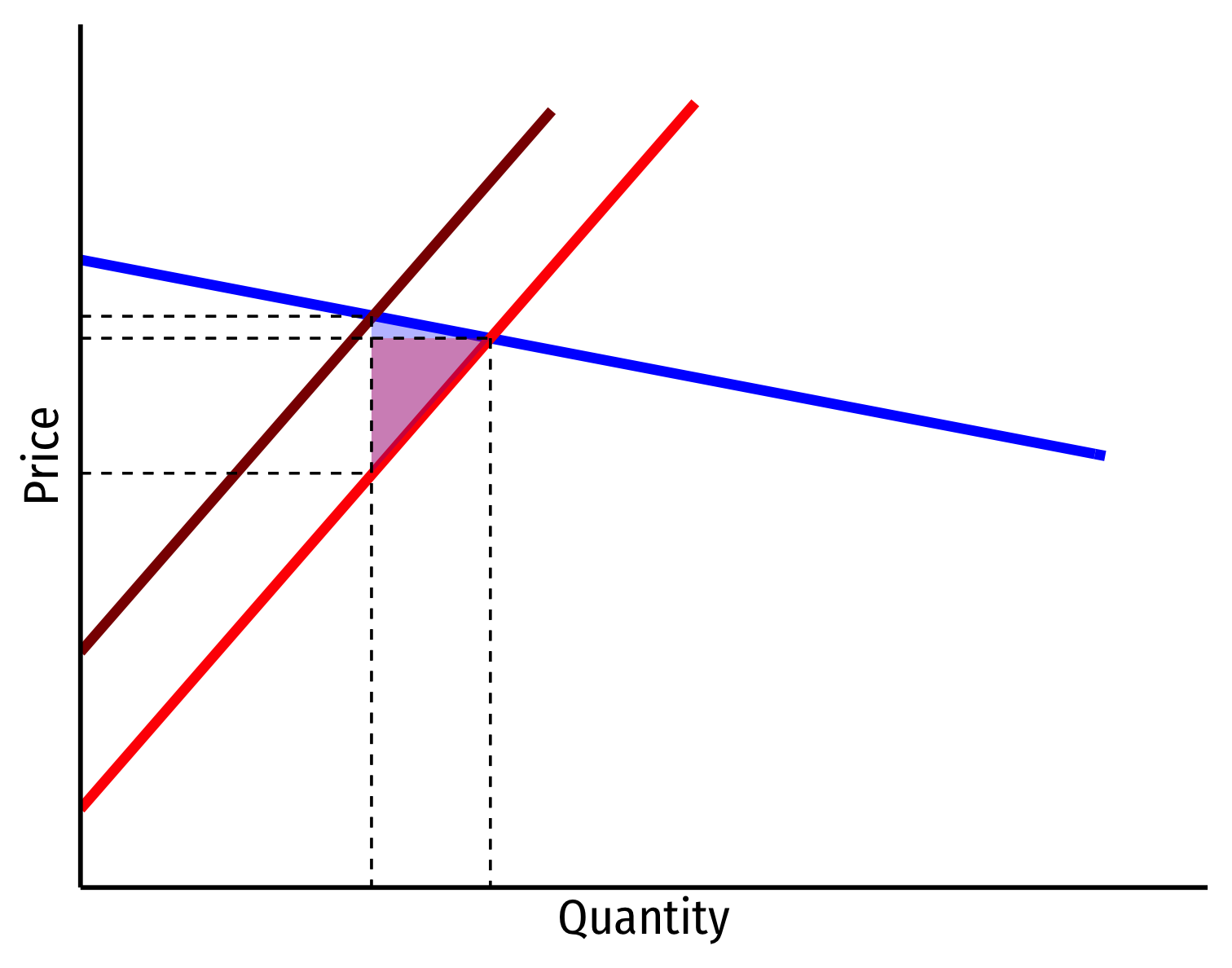

Surpluses lost to DWL from an identical tax on suppliers with:

Supply more elastic than Demand

Demand more elastic than Supply

Relative Price Elasticities and Economic Incidence

Group with a relatively lower elasticity bears more tax burden

Elasticity ⟹ responsiveness in buying/selling behavior to price change

- Elasticity$\implies$ the ability to .hi-purple[avoid] the tax by changing behavior

Relatively more elastic group shifts some burden onto relatively less elastic group

Some Principles of Tax Fairness

Tax Fairness Principles

Benefits principle: those who benefit from public spending should bear the burden of the cost

Ability-to-pay principle: those with a greater ability to pay should pay more taxes (and vice versa)

Ideal "Lindahl Tax": each person pays their max WTP for public goods

- Obviously implausible, not incentive-compatible

Types of Taxes

Progressive tax: (effective) tax rates increase with taxable activity

- Income tax: Higher-income groups pay higher tax rates

Regressive tax: (effective) tax rates decrease with taxable activity

- Sales tax: Lower-income groups pay more in taxes (consume more, invest less, compared to wealthy)

- Payroll tax: caps out at a maximum

Flat tax: tax rates are the same for everyone

Marginal vs. Average Tax Rates

For many taxes, especially individual income tax, key difference between:

Marginal tax rate: tax rate on last (marginal) dollar of taxable income

- individual income tax has increasing marginal tax rates (progressive)

Average tax rate: ratio of total taxes paid to total taxable income

Individual Income Tax: Marginal Tax Rates

Individual Income Tax: Distribution

Individual Income Tax: Average Tax Rate

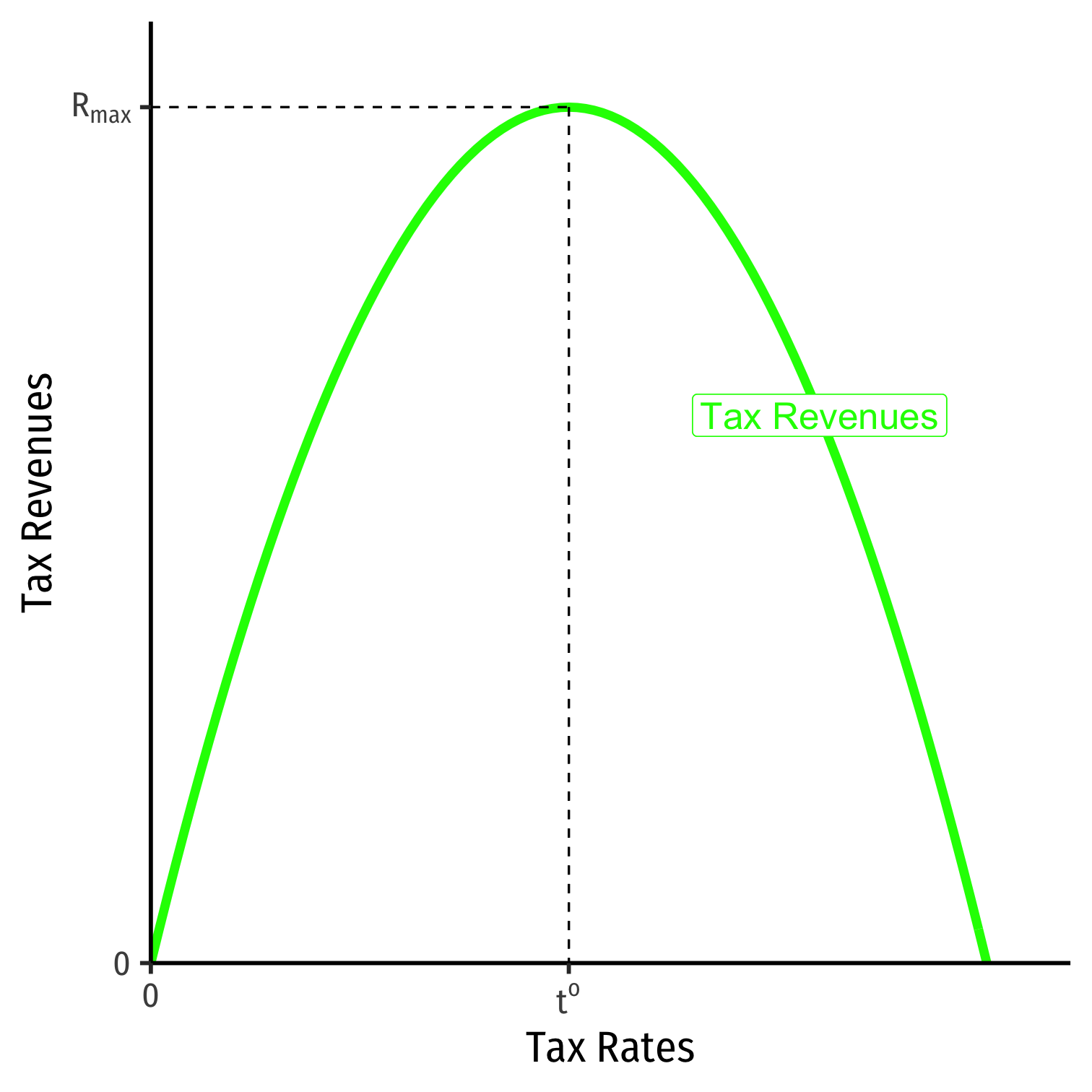

Taxes Distort Incentives

Taxes Distort Incentives

Taxes have two effects:

Raise revenue for State

Discourage individuals from taxed activity

- reduce activity

- find untaxed substitutes (legal or illegal)

- engage in hoarding, tax avoidance

- Optimal tradeoff between two effects for revenue-maximizing government

Larger Taxes Create Disproportinately Large Distortions

- Tax of t:

- G1=8

- DWL1=1

Larger Taxes Create Disproportinately Large Distortions

Tax of t:

- G1=8

- DWL1=1

Tax of 2t:

- G2=12

- DWL1=4

Higher tax rates increase the rate of loss of surplus

- ΔG=1.5x increase

- ΔDWL=4x increase

In fact, ΔDWL=(Δt)2

Using The Tax System for Political Goals

Taxes and subsidies are political tools politicians can use to bargain and benefit special interest groups

- Special deductions, tax credits, tax breaks, etc.

This is why our tax code is so complicated!

This is also why you get your health insurance through your employer

Using The Tax System for Political Goals: Some Examples

Businesses can deduct interest payments on their debt from corporate taxes, but not on dividend payments to shareholders ⟹ corporations use more debt than equity

R&D tax credit: businesses can reinvest corporate profits into research and development to avoid corporate income taxes

401(k)s benefits are not taxed ⟹ people invest more in 401(k)s for retirement

Homeowners can deduct mortgage interest payments from their taxes, but renters cannot deduct anything ⟹ more homeownership than renting

Messing With the Tax Code: Good Politics

Messing With the Tax Code: Consequences

Messing With the Tax Code: Consequences

Messing With the Tax Code: Consequences

Messing With the Tax Code: Consequences

Messing With the Tax Code: Consequences

Tax Avoidance and Tax Evasion

- Tax Evasion: illegal actions of not paying taxes due (on income, wealth, property, etc)

- alternatively, turning to black markets for un-taxed substitutes

- concealing assets from the government, offshore, etc.

Tax Avoidance and Tax Evasion

- Tax Avoidance: legal actions that changing behavior and wealth allocations to minimize the amount of taxes due

- buying non-taxed substitutes

- using tax deductions, credits, loopholes, exemptions, trusts, foundations

- reinvesting corporate profits

- having good accountants

Tax Avoidance

- More of the world than you imagine is optimized for tax avoidance

Tax Avoidance

- More of the world than you imagine is optimized for tax avoidance

In Ukraine, an imported car is taxed heavily, so importers cut the cars in half (which are taxed lighter as ”spare parts” and then welded back together in the country))

Tax Avoidance

- More of the world than you imagine is optimized for tax avoidance

In the Netherlands, houses were taxed based on their canal frontage (rather than height or depth), so they were built tall and thin (to minimize canal frontage)

99% Invisible: Vernacular Economics: How Building Codes & Taxes Shape Regional Architecture

Tax Avoidance

- More of the world than you imagine is optimized for tax avoidance

In the UK, property taxes used to be based on the number of windows a building had, so many buildings still feature ”bricked up” window slots

99% Invisible: Vernacular Economics: How Building Codes & Taxes Shape Regional Architecture

Raising Taxes?

Raising Taxes?

Wealth Taxes?