1.2: Externalities & Bargaining

ECON 410 · Public Economics · Spring 2020

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/metricsf19

publicS20.classes.ryansafner.com

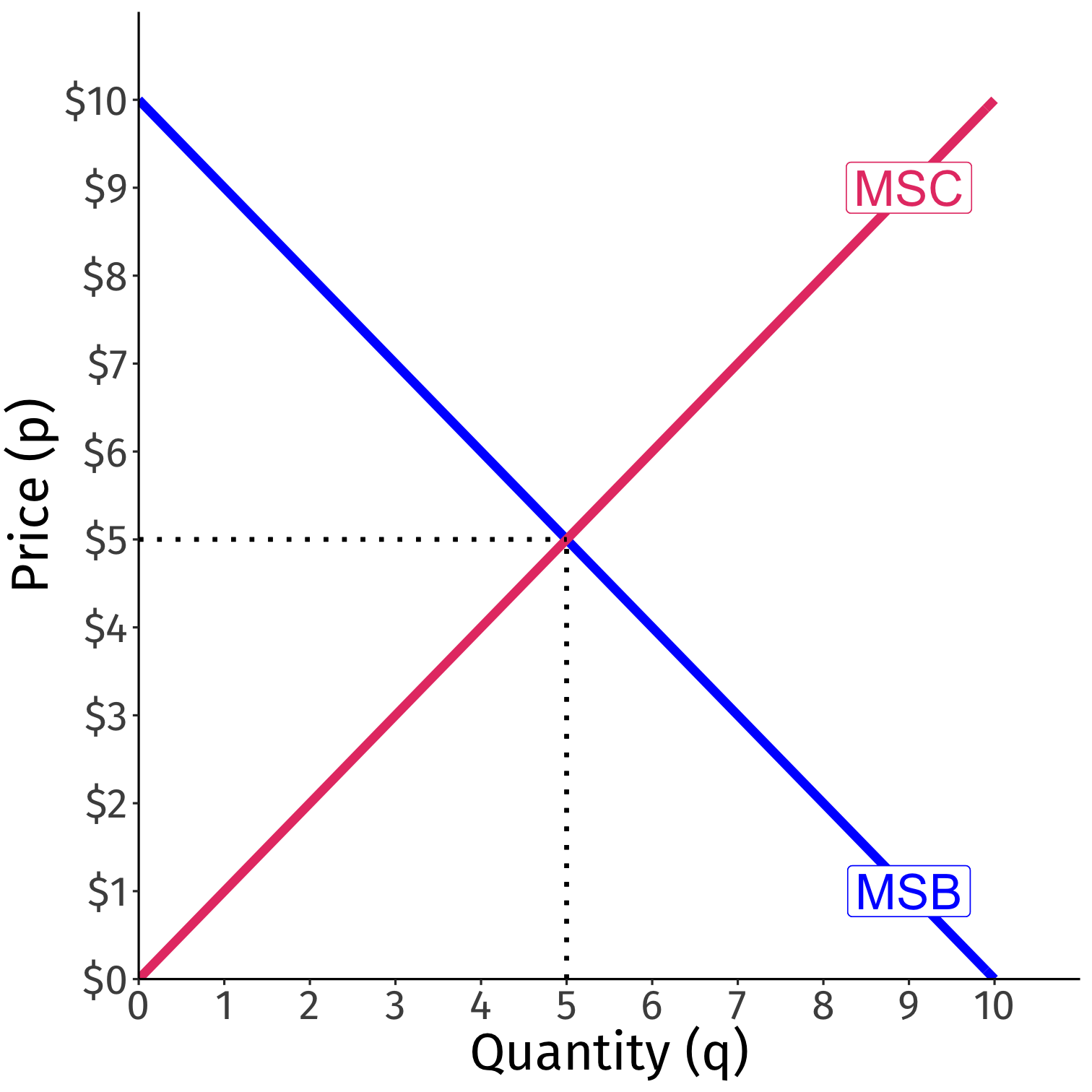

Supply and Demand: Social Costs & Benefits

Demand: marginal social benefit (MSB)

- value to consumers of consuming output

Supply: marginal social cost (MSC)

- opportunity cost of pulling resources out of other uses

Equilibrium: MSB=MSC

- using resources efficiently, no better alternative uses

Supply and Demand: Social Costs & Benefits

Price system mitigates costs and benefits of people's actions

People using scarce resources must account for consequences:

- Pay to pull scarce resources out of other uses in society

- Compensated for producing something valuable for others

Externality

Externality: an action that incurs a cost or a benefit not compensated via prices

Often interpretted as an action that affects (benefits or harms) a third party not privy to the action

Externality

The real problem is that it is external to the price system!

People base decisions off of their preferences and opportunity costs of resources for society (captured in prices)

Prices properly negotiate the opportunity costs and provide information to people

But without price, decisions do not internalize those effects!

Pigouvian Solutions

A.C. Pigou

1877-1959

1920, The Economics of Welfare

Principle of "payment in accordance with product"

People should pay average externality of their actions

- Markets make you do this automatically

- If markets fail, policy can force the market to work again

Problem with externality is that there is a missing price!

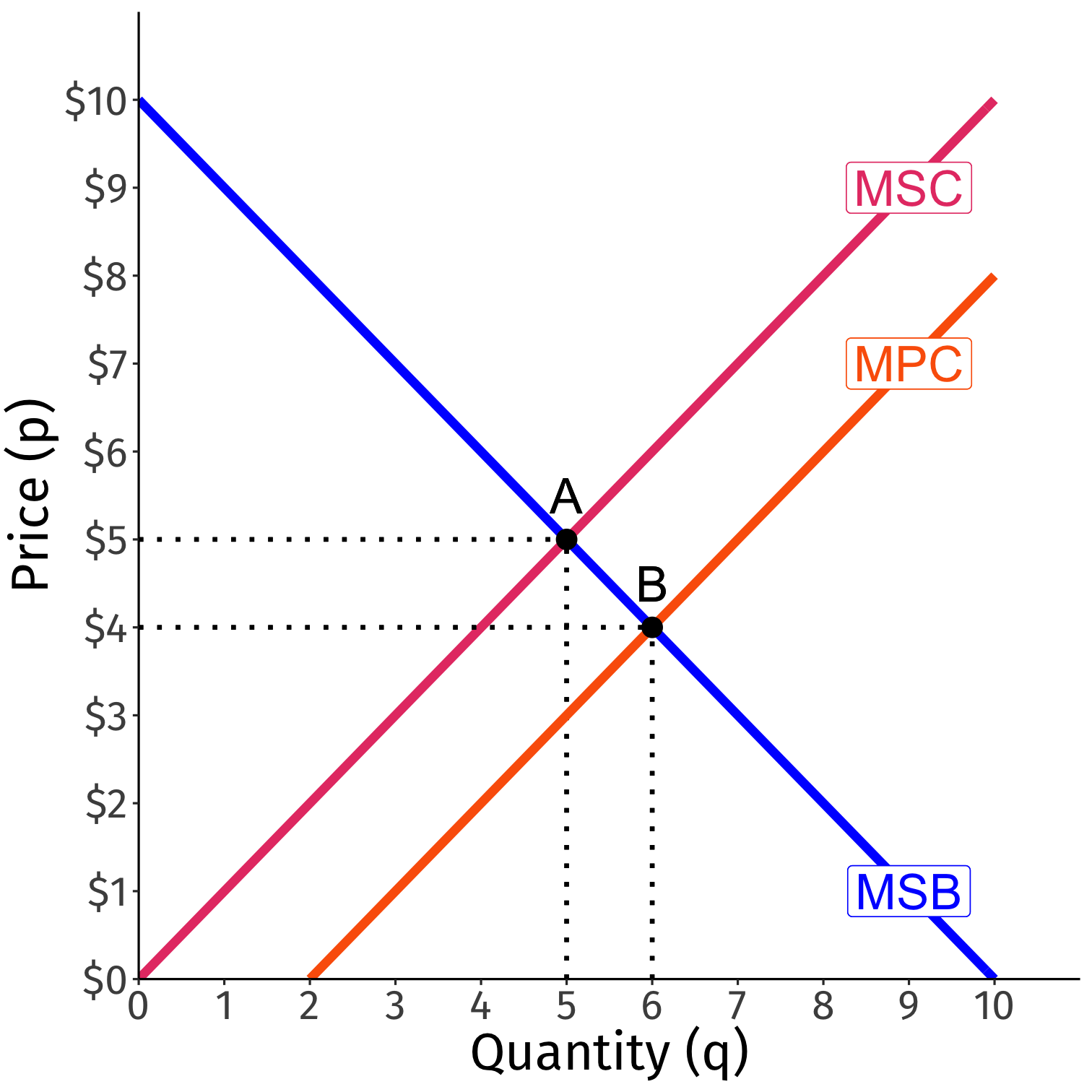

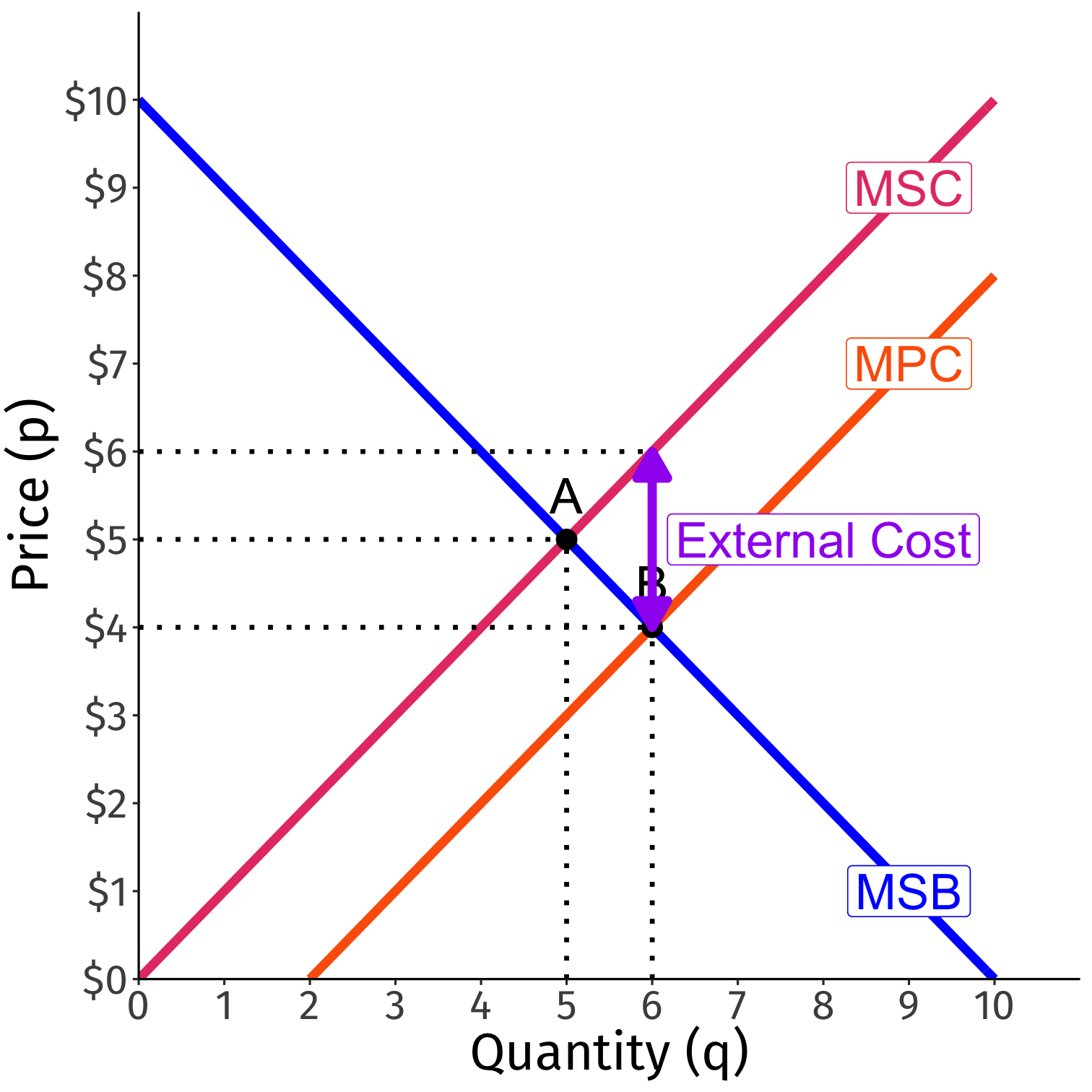

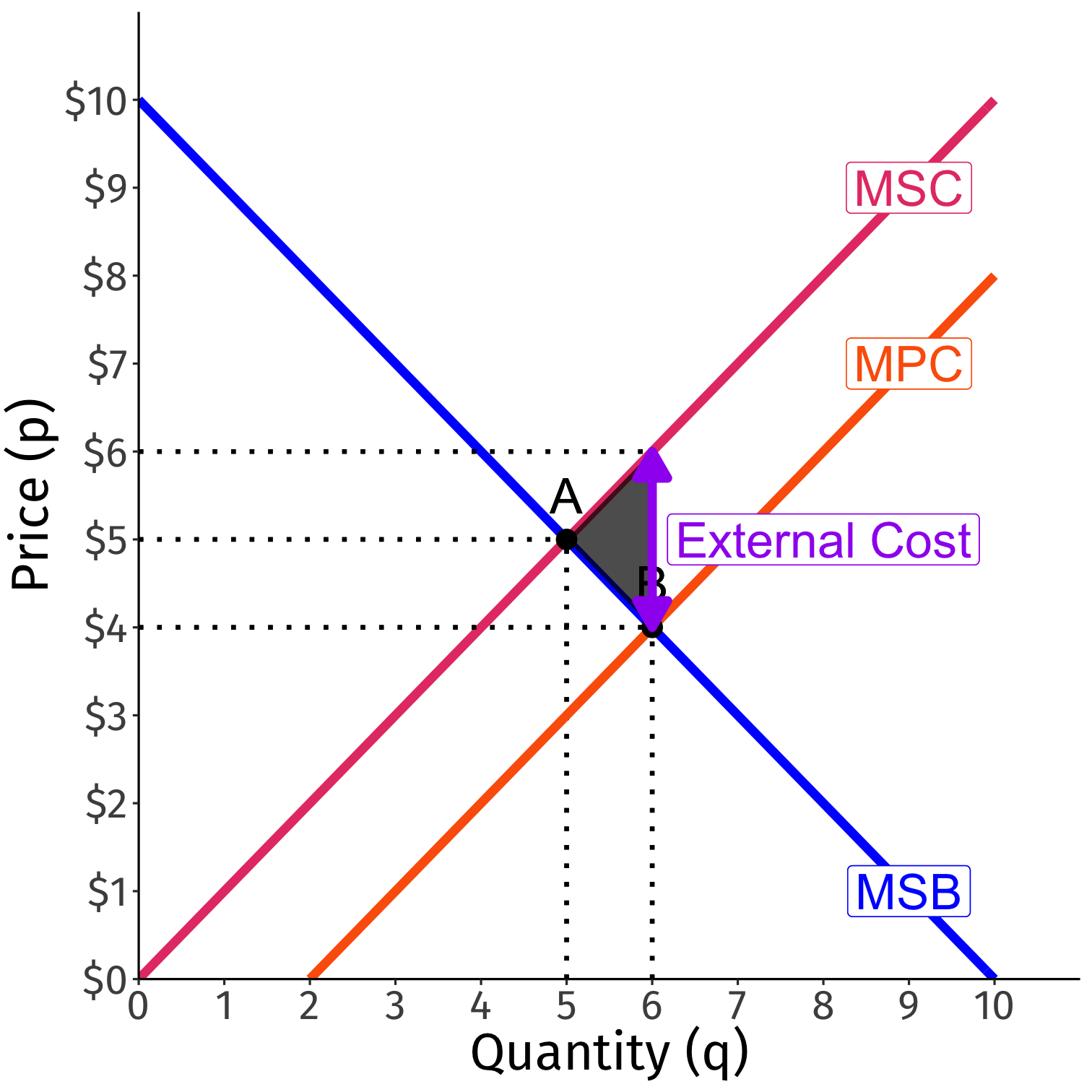

Negative Externality

Marginal Private Cost to producer is less than Marginal Social Cost to society

Market Equilibrium (B) too much q at too low p compared to Social Optimum (A)

Negative Externality

Marginal Private Cost to producer is less than Marginal Social Cost to society

Market Equilibrium (B) too much q at too low p compared to Social Optimum (A)

- Overproduction due to external cost

Negative Externality

Marginal Private Cost to producer is less than Marginal Social Cost to society

Market Equilibrium (B) too much q at too low p compared to Social Optimum (A)

Overproduction due to external cost

A deadweight loss from overproduction

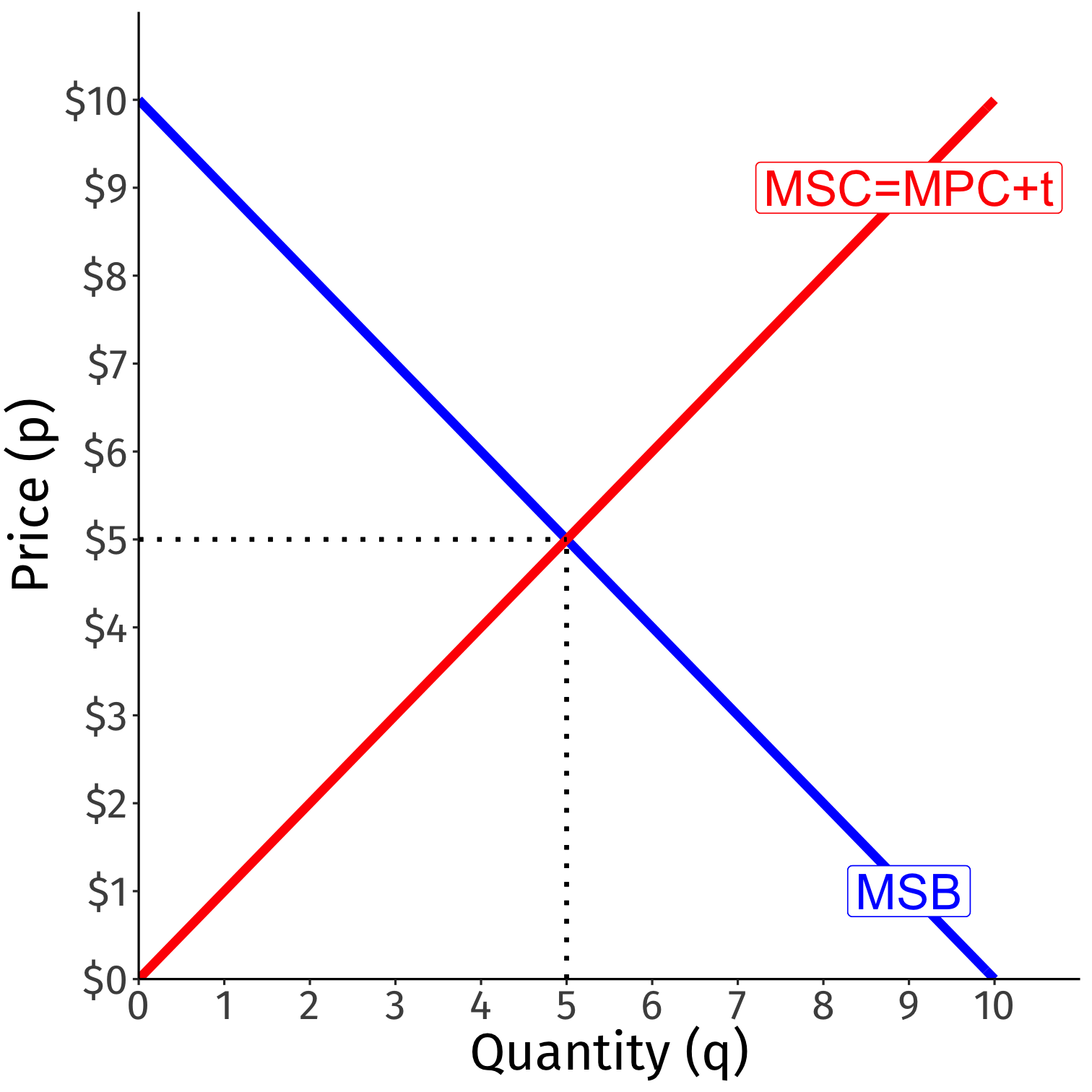

Negative Externality: Pigouvian Solution

A.C. Pigou

1877-1959

Policy solutions to externalities should focus on the missing price

- Narrowly tailor policy to create or modify price

"Pigouvian" tax or subsidy

Negative Externality: Pigouvian Solution

Set a specific tax t=MSC−MPC

Eliminates the DWL

Internalizes the externality into the price system

Producers (and consumers) now consider the true cost to society

- MPC (with tax) =MSC

Pigouvian Taxes

"Sitting is banned in the following places: "in St. Mark’s Square and in Piazzetta dei Leoncini, beneath the arcades and on the steps of the Procuratie Nuove, the Napoleonic Wing, the Sansovino Library, beneath the arcades of the Ducal Palace, in the impressive entranceway to St. Mark’s Square otherwise known as Piazzetta San Marco and its jetty." ($200)

Pigouvian Taxes

"I. A carbon tax offers the most cost-effective lever to reduce carbon emissions at the scale and speed that is necessary. By correcting a well-known market failure, a carbon tax will send a powerful price signal that harnesses the invisible hand of the marketplace to steer economic actors towards a low-carbon future."

Signed by 27 Economics Nobel Laureates, 4 former Federal Reserve chairs, among many other famous economists

Pigouvian Taxes

"II. A carbon tax should increase every year until emissions reductions goals are met and be revenue neutral to avoid debates over the size of government. A consistently rising carbon price will encourage technological innovation and large-scale infrastructure development. It will also accelerate the diffusion of carbon-efficient goods and services."

Signed by 27 Economics Nobel Laureates, 4 former Federal Reserve chairs, among many other famous economists

Pigouvian Taxes

"III. A sufficiently robust and gradually rising carbon tax will replace the need for various carbon regulations that are less efficient. Substituting a price signal for cumbersome regulations will promote economic growth and provide the regulatory certainty companies need for long-term investment in clean-energy alternatives."

Signed by 27 Economics Nobel Laureates, 4 former Federal Reserve chairs, among many other famous economists

Coase (1960)

Ronald H. Coase

(1910-2013)

Economics Nobel 1991

"The traditional approach has tended to obscure the nature of the choice that has to be made. The question is commonly thought of as one in which A inflicts harm on B and what has to be decided is: how should we restrain A? But this is wrong. We are dealing with a problem of a reciprocal nature. To avoid the harm to B would inflict harm on A. The real question that has to be decided is: should A be allowed to harm B or should B be allowed to harm A?" (p.2)

Coase, Ronald H, 1960, "The Problem of Social Cost," Journal of Law and Economics 3:1-44

Externalities as a Property Rights Problem

Ronald H. Coase

(1910-2013)

Economics Nobel 1991

Harm is often bilateral, not unilateral

Takes two parties to have a dispute

A ⟺ B

Origin of the problem is rights are not clear (undefined or unenforced)!

Who has right/responsibility over activity creating the external harm?

Coase, Ronald H, 1960, "The Problem of Social Cost," Journal of Law and Economics 3:1-44

Coase: An Example

"[Imagine] the case of a confectioner the noise and vibrations from whose machinery disturbed a doctor in his work. To avoid harming the doctor would inflict harmon the confectioner. The problem posed by this case was essentially whether it was worth while, as a result of restricting the methods of production which could be used by the confectioner, to secure more doctoring at the cost of a reduced supply of confectionery products," (p.2).

Sturges v. Bridgman (1879) LR 11 CH D 852

The Pigouvian View

A.C. Pigou

1877-1959

Confectioner is injuring the doctor, the victim and not internalizing the external cost of his machinery

Harm: A→B

Tax offender (A) until his MPC = MSC

Coase's Perspective

Ronald H. Coase

(1910-2013)

Economics Nobel 1991

"The doctor's work would not have been disturbed if the confectioner had not worked his machinery; but the machinery would have disturbed no one if the doctor had not set up his consulting room in that particular place..." (p.13).

Property Rights and Externalities

Court must must imposing a cost on either the defendant or plaintiff

Real issue is the social balance of efficiency

At what rate is society willing to give up confections for medical services, and vice versa?

The "Coase Theorem"

Coase Theorem: if transactions costs are low, clearly defined property rights allow parties to bargain to the efficient social outcome regardless of who has the property right

Wealth and distribution effects will change (who pays who)

The "Coase Theorem"

If there are mutual gains from exchange to be had, parties will find a way to capture them

Resources will flow towards highest-valued uses

Coase: there's nothing new here if you understand Adam Smith!

The "Coase Theorem" in Sturges v. Bridgman

It doesn't matter for social efficiency to whom the property right is awarded, so long as parties can bargain

If Doctor wins: confectioner can pay doctor to make noise, or buy soundproofing

If Confectioner wins: doctor can pay confectioner to slow/quiet production, or buy soundproofing

The "Coase Theorem" is Misunderstood

Its really George "Stigler's Coase Theorem"

Simplifying assumptions of zero transactions costs

The "Coase Theorem" in the Real World

In real world of transactions costs, the assignment of property rights matters!

Property rights and resources are sticky!

Means some allocations are more efficient than others!

The "Coase Theorem" in the Real World

Coase: forget "Blackboard economics" and go study the real world of institutions

Launches "Law & Economics" field

How should property rights be assigned to minimize the total cost of externalities and to maximize efficiency?

Externalities Adjudicated at Law

Most externalities in U.S. mediated through common law legal system

Courts assess how much harm was caused

Individuals causing harm to others must pay:

- compensatory damages (to redress harms)

- punitive damages (to deter future externalities)

Externalities persist if property rights are not clear or are not enforced